Watch the Webinar: Get Your SEO in Order

Throughout the Coronavirus pandemic, marketers are being asked to do more with less. Many of us are finding that our budgets are being cut and sometimes that means cutting back on advertising, such as paid search and social. However, there are still many digital strategies and programs that you can control and even improve, including your SEO strategy.

Now is the perfect time for marketers to review, clean and improve the SEO for their business. In this week’s 15 Minute Digital Planning Webinar, we interview our Director of SEO, Jacob King to identify the key strategies marketers can implement right now to improve their SEO strategy, such as:

Focusing on the structural content on your website and ensuring pages are visible to search engines so they’re easy to find.

Focusing on the structural content on your website and ensuring pages are visible to search engines so they’re easy to find.- Adding structured data (events) when possible. This is especially useful for industries that have traditionally used events or in-person meetings for their business, such as realtors.

- Re-purpose well performing secondary content such as how to guides, blog posts, e-guides and webinars.

- Link content sufficiently from higher profile pages, such as footers or headers on your home page to pass on link equity.

In the webinar, we’ll also cover how some industries are creatively solving for their needs now and building SEO to benefit their business in the future using creative tactics such as virtual events and much more. Watch the webinar for free:

At LQ Digital, we’ve captured a lot of data over the last 15 years on what scores as best-in-class digital performance (search, social, affiliate). At this time we want to contribute by sharing our data, knowledge and expertise to help your company survive this turbulent time and provide relief.

Remember to subscribe to our webinar series so you always have the latest news and insight in your inbox: subscribe here.

Google Shopping: Now Open to Unpaid Listings, Watch the Video

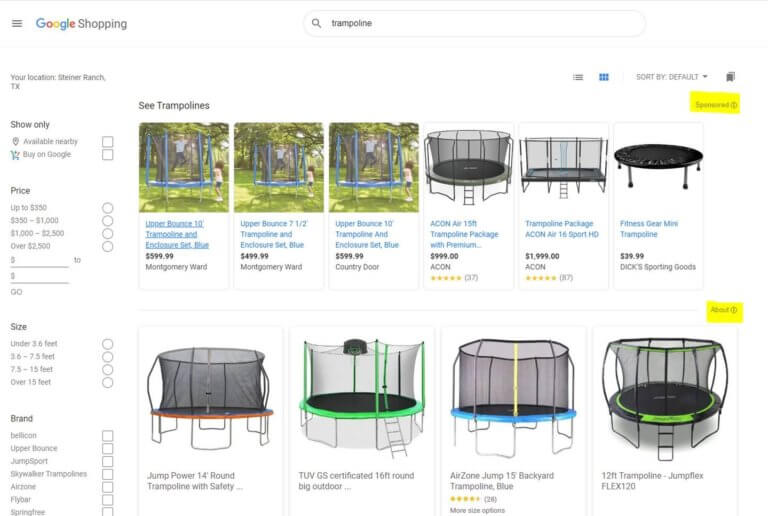

Last week, Google made a surprising announcement and opened up their Google Shopping platform to unpaid product listings. The move comes as many brick and mortar retailers were forced to close their doors (at least temporarily) due to the Coronavirus pandemic and may now be looking to more e-commerce opportunities.

So what does this shift mean for merchants? As part of our weekly webinar series where we highlight digital planning strategies to combat the Coronavirus pandemic, we interviewed VP of Strategic Accounts, Phil Strohl to better understand what this shift in Google’s offering means and how marketers can leverage this new opportunity.

Watch the quick 15 minute video above to uncover:

- What the Google Shopping opportunity means for existing Google Merchants and Merchants that have never used the platform.

- Where to get started if you’ve never used Google Shopping before and what to tackle first for the biggest advantage.

- Key recommendations to maximize the Google Shopping feature, such as: review & optimize product feeds and add products that may have been excluded previously due to a low Return on Ad Spend/margin.

The new experience is live on Google Shopping. Separate “Sponsored” and “Organic” results sections highlighted.

At LQ Digital, we’ve captured a lot of data over the last 15 years on what scores as best-in-class digital performance (search, social, affiliate). At this time we want to contribute by sharing our data, knowledge and expertise to help your company survive this turbulent time and provide relief.

Still have questions or want a us to cover a particular topic? Email us at ehoffman@lqdigital.com and remember to subscribe to our webinar series so you always have the latest news and insight in your inbox: subscribe here.

15 Minute Digital Webinar: Make Paid Search Work for You

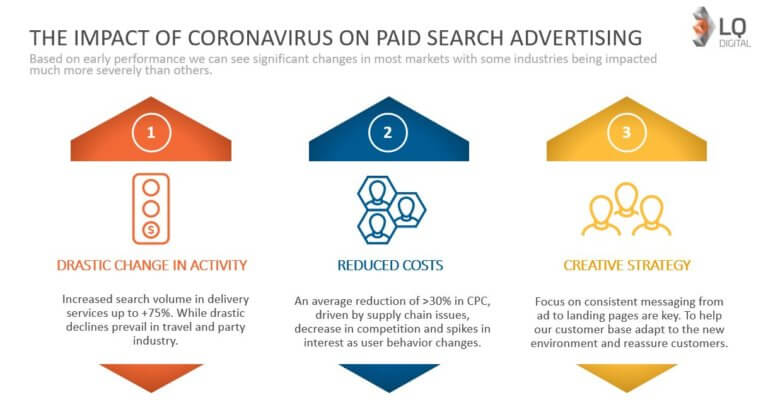

The Coronavirus pandemic has impacted nearly every industry and as such, marketers are juggling multiple challenges. As the financial arms of companies start to intervene and make more of the larger business decisions, marketers are finding that their budgets are slashed and as a result, are having to do more with less. So how can marketers reach new customers in such uncertain times and more importantly, how can they optimize and ensure the investments they DO make are making an impact on the increasingly important bottom line?

As part of our weekly 15 Minute Digital Planning Survival Guide webinar series, we interviewed Monica Niblack, VP of Strategic Accounts at LQ Digital to better understand how the pandemic has impacted Paid Search, what marketers should be paying attention to and steps they can take to improve their efforts.

Learn how to make Paid Search work for you and even uncover new growth opportunities using strategic tactics, such as:

- Reminding yourself of the core of your customer acquisition strategy, so you can stay laser focused on your target segment, channel priority and creative – but also understand where to pivot. Instead of pausing all of your Paid Search efforts, now is the time to get really clean and strategic.

- Since media costs have fallen so quickly, it opens up opportunity to refresh old campaigns that could not meet previous profitability targets – so now is the time to take advantage of shorter, faster testing.

- Find new profitable growth areas with faster testing of the marginal economics and incrementality (vol / cost). This type of testing is vital right now. At LQ Digital, we’ve used this method to open up new revenue opportunities for clients that otherwise, would be more severely impacted during the shutdown.

- Continually re-verify and monitor your key profitability and conversion metrics all the way down your funnel to revenue. Depending on which stage you see performance changes, it can lead to different remedies to changing creative, target segments and bidding.

At LQ Digital, we’ve captured a lot of data over the last 15 years on what scores as best-in-class digital performance (search, social, affiliate). At this time we want to contribute by sharing our data, knowledge and expertise to help your company survive this turbulent time and provide relief. Watch the webinar for free here:

Digital Survival Guide Webinar: Make Paid Search Work for You

Still have questions or want a us to cover a particular topic? Email us at ehoffman@lqdigital.com and remember to subscribe to our webinar series so you always have the latest news and insight in your inbox: subscribe here.

High-tech + Low-tech Growth Challenges for Mortgage Lenders

The mortgage industry has faced a number of challenges in recent years: technological advancements, increasing competition and lack of entry-level housing. All of which have added mounting pressure to mortgage lenders looking for growth and profitability. However, most lenders have also relied on low interest rates & the refinance boom to fuel their loan growth the last year or two. With new, well-financed lenders disrupting the market and the threats of higher mortgage rates and tighter lending standards in 2020 and 2021, leading lenders are starting to prepare for greater competition.

So how are lenders responding?

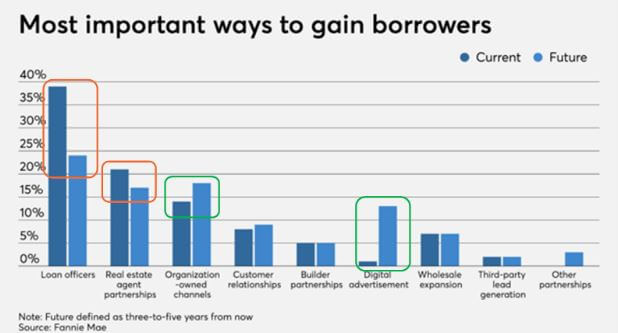

A recent article by National Mortgage News reviewing Fannie Mae’s Dec 2019 Mortgage Lender Sentiment Survey reports a majority of lenders are planning to fuel their growth over the next 3-5 years by diversifying where they source new loan leads. They will be adding to their traditional model of relying primarily on LO networks and RE partnerships, by dramatically increasing their investments to generate leads from digital channels (owned and paid). The goal is to help them generate more leads, particularly from the younger generation who favors mobile and digital engagement.

Interestingly, at the same time, additional articles from National Mortgage News have called out that despite this shift to more digital mortgages, Personalization still matters. Although more future customers will be researching more online, and looking for more efficient online options to streamline much of the borrowing process, it does not mean their journey ends behind a screen. When borrowing hundreds of thousands of dollars on a home loan, it turns out most people (even millennials) state that they prefer at some point to talk to a human being.

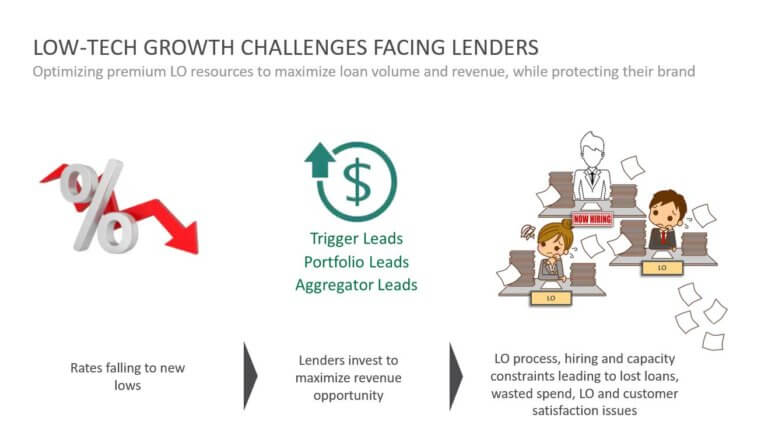

However, in the very low rate environment we have experienced for the last year, many lenders we work with are “jumping in” with increased budgets to take advantage of this great lending opportunity. The biggest operational hurdle many face is keeping enough loan officer capacity on line, and operating at optimal efficiency, to keep up with demand. Added hiring increases labor costs that eat away at margins, while hiring delays stall growth and reduce revenue. Finding ways to maximize the amount of existing loan officer capacity focused on closing loans (vs being distracted with qualifying or nurturing lower-quality leads), while increasing their efficiency at closing, is the virtuous cycle that generates maximum growth in closed loans units, revenue and profits.

However, in the very low rate environment we have experienced for the last year, many lenders we work with are “jumping in” with increased budgets to take advantage of this great lending opportunity. The biggest operational hurdle many face is keeping enough loan officer capacity on line, and operating at optimal efficiency, to keep up with demand. Added hiring increases labor costs that eat away at margins, while hiring delays stall growth and reduce revenue. Finding ways to maximize the amount of existing loan officer capacity focused on closing loans (vs being distracted with qualifying or nurturing lower-quality leads), while increasing their efficiency at closing, is the virtuous cycle that generates maximum growth in closed loans units, revenue and profits.

This blog reviews the best practices we have identified over 15 years to drive loan volume and revenue growth for both large traditional lenders and disruptive digital startups (across mortgages, HELOC, equity loans, educational and personal). These fall into two basic categories.

- High-tech (Digital Growth) strategies

- Low-tech (LO Efficiency) strategies

Strategy 1: Building a Successful, Modern Digital Growth Strategy

The digital native generation – millennials – are finally coming to market after years of postponing home ownership. So if you want to be profitable in the years to come there are 3 key principals we guide our marketing executive clients to think about and solve.

1. Separating KPIs from Economics

Too many marketers focus on upper-funnel vanity metrics (e.g. impressions, clicks, CTR, CVR) instead of translating and speaking at all times about their activity in terms of its bottom-line impact on growth metrics that drive their business (e.g. how many units were sold, at what unit value, at what CPFL or LTV/CAC). Only by refocusing on business growth metrics can a marketer judge and measure the true value of different growth strategies.

2. Full Funnel Visibility

Many lender marketers say they have this, but yet they cannot answer what is their current CPFL. This is because getting this data is hard. It is captured in multiple systems across both sales and marketing, which means it is typically not available to marketing (or if it is, it is not generated daily, but at most monthly) due to the complexity in pulling it together. The lack of having real-time data on the cost per unit sold (CPFL) prevents marketers from having the insights needed to guide media decisions to drive real bottom-line growth. Marketers are too often blind to the true economic impact of their decisions on the business, limiting their ability to delivery true growth.

3. Segments Before Channels

Once you have access to a real-time, full-funnel view into your marketing performance, you can use that data to then answer what are your highest-value target customer segments to prioritize (e.g. which generate higher LTV/CAC). By knowing what each segment is worth, and what they cost you, by channel, only then will you be armed to build the optimal media plan (across each channel) to maximize your total business growth at the lowest blended cost.

Our Feb 2020 webinar with Blend talks in more detail about how leading mortgage lenders can use these lessons to modernize their digital customer acquisition strategy to generate loan growth in 2020 and beyond (view the webinar here).

Strategy 2: Leveraging a Contact Center To Maximize LO Closed Sales

Over the last 15 years, our Contact Center Services have partnered in growth campaigns with clients operating in several complex, considered-purchase product environments (e.g. lending, real estate, education, B2B technology and B2C subscription services). In each we proved how strategically leveraging call center resources:

- Satisfied the personalization needs of the potential borrower.

- Created a positive customer experience that strengthened their relationship with the lender’s brand.

- Improved conversion rates by proactively engaging potential borrowers (e.g. loan app not completed) in a live discussion to accelerate their movement down the sales process.

- Qualified out leads that would not qualify for a loan or were not serious about applying today, before having them speak with a loan officer.

By strategically leveraging a call center team to offload some of this early-stage work otherwise left to LOs, the number of leads that can move through the sales process increases dramatically. This results in increasing closed loan volumes by maximizing the LO time spent closing qualified loan applicants – while simultaneously reducing the new LO hiring requirements to reach those higher closed-loan numbers.

Our whitepaper “The Power of the Call: Your Secret Weapon to Maximize Revenue and Reduce Costs” describes the specific methods for leveraging a Contact Center to help you maximize the loan-closing impact of your existing LO resources, improve conversion rates and reduce cost-per-lead (download the whitepaper here).

Marketing Your App: Connecting Your Systems for the Data Advantage

App marketers face unique challenges when growing their business but they all share a common goal: to find, acquire and retain quality users in today’s crowded app space. When we talk to growth marketers, there are 2 primary areas of focus in the app business or hybrid app & web business space:

- To find and attract new users to download the app

- To keep those that downloaded the app engaged with the brand & coming back for more

Often marketers look at these as two separate challenges and strategies, but we think the problem is one in the same. If you want repeat customers that will continue to engage with your brand (and repeatedly return to the app), wouldn’t it make sense to target those users in the first place? By targeting customer segments that the data already shows to be more prone to higher usage and loyalty, marketers can save money, time and plenty of headaches.

Intuitively, marketers know this. However, a lot of app marketers focus predominantly on CRM marketing campaigns leveraging their own in-app data and analytics. For example, at this year’s Mobile Growth Summit in San Francisco, multiple presentations centered around retargeting best-practices to incentivize users that initially downloaded an app to continually return and engage with the app long-term.

Tracking app user behaviors that drive usage and retention is clearly important. However, focusing only on in-app data misses the larger opportunity to connect in-app and CRM “profitability-signal” data to customer segmentation, behavioral, demographic, and mobile app / web campaign data captured outside of the app and across different marketing platforms and digital channels. Plus, your highest-revenue customers don’t live in one channel or on one platform – so unless you have a strategy for capturing that data – you are missing out on crucial cross-channel behaviors that could clue you into where to find your best customers in the first place.

By connecting data from the top of the marketing funnel to data from every conversion step (post download) down to revenue, marketers can uncover what audience attributes they should target because their own data shows they highly correlate to customers who turn into long-term revenue generators. This is difficult to do. One of the reasons why is that it often requires managing and combining multiple tools and products – that quickly becomes overwhelming. Internal digital media specialists might know how to work with Facebook, Google Apple, etc. to kick off marketing campaigns for new app downloads. And at the surface level, it can seem easy. Afterall, Google and Facebook use AI to automate much of the traditional media campaign targeting options (e.g. building, etc.). But, is your team well equipped or experienced enough to access down-funnel app or CRM data? That data can be crucial to building hyper-targeted audience strategies that drive not just downloads but trials, registrations, account funding, in-app purchases, 1st-rides or any other downstream conversion events that much more closely map to revenue growth.

“Heads of Growth”, and “growth” marketers in general are being held more and more accountable to explicit revenue growth targets. They are finding very quickly that succeeding and surviving requires that they get very good, very quickly in 3 key areas:

- Getting the right data

In order to be able to tie app-download campaigns to high-value customers that will more consistently turn into in-app revenue, you need the data that tells you what signals to look for in order to find these customers in the first place. More data isn’t necessarily better – it just gets more complicated and can become very time consuming. Even if you have a data team dedicated to this problem, they still need to find a way to map the data together, learn how to focus on the right signals, and generate daily (not weekly, monthly or quarterly) data-driven insights into which audiences turn into revenue. Yet, the mistake many marketers make is they try to hang themselves on data but end up getting lost and not focusing on what’s important.

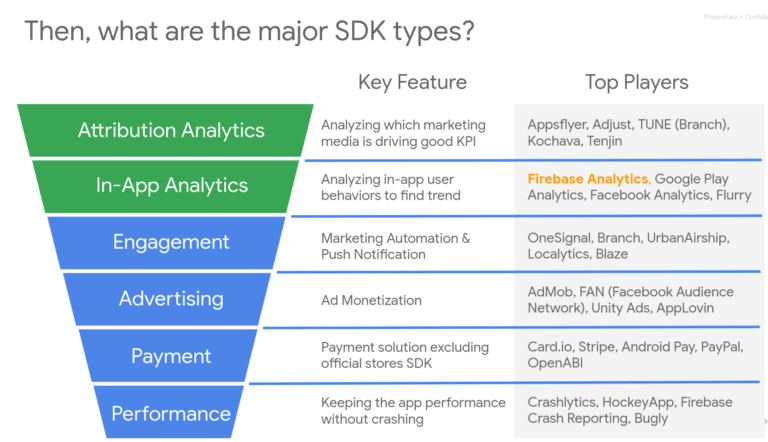

Additionally, app marketers need to get a handle on their app data & analytics. Working with a 3rd-party attribution partner can help take the burden and complexity off your plate. App Annie, AppsFlyer and Adjust are mobile in-app tracking tools that are pretty easy to install via their SDKs and can provide really key insights into your app sessions, conversion tracking and additional KPIs. There are several options depending on your needs and desires:

None of these 3rd-party tools are really designed to analyze deep users’ behavior, however it is possible to analyze key down-funnel events coming from marketing channels, including cohorts, LTV, installs, clicks and more. As an example, Firebase by Google, can monitor data, analytics and tracking from the app across the Google landscape – meaning if someone were to see an ad to download your app via YouTube, Firebase could help you track and measure that journey – but only if it’s from one’s mobile device or while they’re logged in or connected to their Google account. The takeaway here is in-app data is important and something app companies need to focus and get a handle on, but it still doesn’t solve the problem of connecting your in-app data to outside app activities. Which brings us to our next point…

- Solving the integration problem

To successfully grow your app business, you will need to connect your web, app store and CRM data to your in-app analytics data. Deep linking is especially important in mapping data captured at every step of your customers’ conversion journey, and it’s a complicated problem to solve unless you have expertise already on staff. Currently, it’s not possible to track someone who finds an app on their desktop to later then download the app on their phone. Many systems are working on this but it hasn’t been solved for yet – meaning, you can’t do this with just one tool, channel expert or platform. Some companies will hire a channel expert say with Facebook or Google, and while those experts have valuable insight into major players and platforms for businesses – people live outside those platforms. If you only focus on Facebook – you’re missing out on key user activity and data that’s happening on YouTube or some other channel. The same can be said for Google. It’s dangerous to focus only on 1 or 2 key channels if you really want to grow and scale your business by finding the right LTV customers.

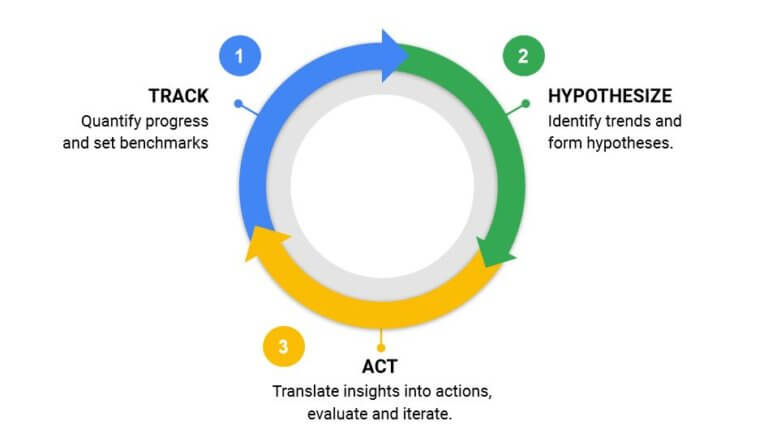

Ready for the rest of the fun? Data integration is truly never done. People have a false notion that an individual or platform will solve a data problem like it’s a check mark, but it really goes on forever. Marketing data turns over completely in 2 years on average, so you can’t just deploy and walk away. If you want your in-app data to connect with your out of app user activity, you simply need a way to integrate the 2 systems and continuously feed that in-app data activity into the app-marketing activities across multiple platforms – like Google, Facebook, YouTube, Bing and others – to truly get a sense of where your customers live in order to find look-a-likes more easily and efficiently. The goal here is to accurately track the data, so you can then hypothesize and identify trends & patterns and then turn those findings into action. All which contribute to your app growth cycle.

- Finding a technology solution.

It’s not simple. If you’re doing this by hand with an analyst, it’s inefficient and won’t scale. Very few out of the box solutions completely solve that last mile problem, so you need a managed service to do that for you. The last mile is what it all comes down to. Without a technology solution, you basically need a data engineer to do the work everyday to ensure the system works, scales and pivots as needed. If you don’t have one on staff, and even if you do, it can feel like an uphill battle that gets steeper and steeper with the more data you collect.

App marketers are faced with a whole other host of priorities and challenges, the data integration, monitoring and successful app marketing doesn’t have to be one. When working with an agency that understands the digital landscape across multiple channels – marketers can collect insights and turn them into marketing actions instead of trying to master data science.

You can meet your growth demands by focusing on customers that are likely to be repeat users in the first place and the answer to finding them is in the data. As the Mobile Growth Summit pointed out, stop hiring channel specialists (Facebook, Google, etc.) in favor of those who bring a broader growth mindset that can actually interpret broader sets of data for you. You also want to own your marketing stack. You need to understand the impact of marketing activities on your business growth metrics. As marketing automation continues (with Google & Facebook) your success will rely on you using the data to teach those algorithms before your competitors get a chance to. You can’t do that if you don’t have the data expertise – which many companies don’t have. We haven’t seen many app companies with a full on staff of data scientists and engineers and that’s ok. Hire the experts to solve the problems for you. Instead, refocus your team investments in creative creation. With the data part handled and experts to help you de-mystify the data and interpret what it really means, you’ll be able to build creative around your main data-proven differentiators for some killer and effective marketing campaigns.

We can take the guesswork out of building this for you. We’ve created successful digital customer acquisition strategies for hundreds of clients, including building marketing app campaigns for FirsTrade and Getaround that grew their businesses exponentially.

Get in touch with one of our digital consultants to find out what we can do for you. Contact us.

Customer Acquisition for FinTech – The David and Goliath Story

Make sure you bring the right sling

By Patrick Wang, Chief Digital Economist, LQ Digital

It seems like every day you hear of a new Fintech startup entering the market with a better mousetrap. New technologies from Google and Facebook have allowed disruptors to reach customers directly, blockchain has created new ways to underwrite contracts, and emerging mobile and data techniques are changing the way companies can deliver financial services quickly and at lower cost to the consumer. Like the David, their ability to strike where it matters have allowed them to exploit chinks in the armor of large traditional financial services companies.

Despite the interest and hubris of all Fintech disruptors however, Fintech companies would be wise to respect that Finserv incumbents are still Goliath’s in the space and for good reason. Challenging them in the wrong way will lead to certain defeat as they can be crushed by their sheer mass and resources. Banks and other financial institutions have spent the better part of a century consolidating and monetizing the value of each customer they capture. They can afford to take a loss on an initial transaction so that they can ultimately cross-sell customers into other services.

Take for example: JP Morgan Chase. After 100+ years rolling up Finserv offerings – they can afford to acquire checking and savings customers at a loss – by creating an engagement vehicle to market a full line of financial services from mortgages, home equity, unsecured loans etc, and vice versa for other product lines.

In contrast, a Fintech disruptor like LendingClub started out tackling personal loans with a best of breed solution – offering quicker funding, better rates, and ease of service based on novel capital sources and new lending risk models. An attractive value proposition on its own, but is it enough to build a competitive business in a room filled with giants?

What’s the Problem?

The challenge for all Fintech disruptors trying to grow profitably is this:

They must be surgically precise about the profile of financial customers they are looking to acquire because:

- Large incumbent banks have had the luxury of being less precise with their customer acquisition strategy because they offer a full line of services (they can bring everyone in and offer something of value)

- Copying a large bank’s broad go-to-market will lead to Fintech disruptors depleting their limited growth budgets, while quickly finding out that they can’t service many of those customers profitably.

Making a hard problem harder is U.S. financial marketing compliance.

- U.S. Fair Lending regulations restrict targeting consumers by many of the dimensions that can signal customer value to a Fintech disruptor. With this constraint, many Fintech companies are quickly forced down a path where they find themselves in a crowded acquisition market with not one, but two or three large incumbents with little room to maneuver.

Fintech disruptors have much less room for error when it comes to acquiring customers.

- Large banks have large balance sheet and an already established portfolio of customers to lean on, so they are insulated from customer acquisition investments gone bad. A fintech disruptor has less margin for error as a bad bet can submarine their growth.

The margin for error continues to erode.

- Cost per clicks (CPC) continue to rise year over year as the competition for growth continues to increase with both traditional finserv and fintech companies going after the same fixed pools of interest.

Bringing a Sling to the Customer Acquisition Melee

What does success require a Fintech disruptor to stand a chance and not get crushed by exorbitant CPC’s, locked up lead marketplaces, and loss-making acquisition?

- Having a clear sense of the specific customer profile where they have an unfair advantage of converting customers.

- Knowledge of both new and old pathways to financial customers and who the customer brokers are in those spaces. Knowledge of these go-to-market channels allows Fintech companies to comply with regulation and at the same time target and segment their customer acquisition.

- A detailed and precise instrumentation of their sales cycle tied to the marketing channels that drive acquisition so that they have confidence in the acquisition investments they are making in advance of revenue.

Why Partner and Why Now?

- Diversity of Skills – Few individuals and organizations have the diversity of skills needed to be a successful all-in-one team (e.g. data science, media buying, conversion design and tech, messaging, etc.). It’s a multi-disciplined approach that requires skills from scrappy startups and knowledge of the “old world”.

- Data Capture / Benchmarking – Success requires capturing as much data as quickly as possible and then comparing those to 3rd-party benchmarks on channel performance. With access to this data, Fintech disruptors can quickly assess – is it our offering? Or is it the customer? Having a partner that’s worked with many other Finserv companies allows you a unique perspective on “what’s to be expected in the space”.

- Measuring Segment Unit Economics (performance from marketing KPIs down to LTV) – Calculating the potential likely future revenue / profit from each lead source or type is critical to helping you direct today’s media spend towards the channels and conversion strategies that will deliver the most revenue and profit, at the lowest marketing cost. Expertise in knowing how to implement accurate data tracking from marketing platforms to your CRM, and then analyzing that data, can be a difficult to find internally in fast-growing startups.

- Time to Market – Once a fintech disruptor’s offering is in market, the clock is ticking. Competitors have a chance to observe and replicate many of the valuable aspects of their offer. Having established relationships with publishers and lead brokers allow companies to accelerate their growth and not stumble over many of the common pitfalls in the industry.

Why LQ?

In short – we have all of the ingredients for Finserv acquisition success.

- For LendingClub we managed media against a cost per issued loan. (So we built data precision on how media turns into revenue, and built markers earlier/higher up in the funnel that signaled which leads were more likely to turn into revenue).

- For one of the largest multi-national financial services institutions, we helped them optimize their Direct to Consumer mortgage channel, accelerating their time-to-market by 1) short-listing the lead partners to work with, 2) rapidly stand up those relationships, and 3) optimizing each relationship against a cost per funded loan performance metric leveraging performance data captured through a lead conversion process we managed.

- For SmartBizLoans, we are able to target the specific profile of small business owners who can both credit and revenue qualify for their loans. (So we know precisely how to target serviceable customers).

Not only has LQ worked with a large portfolio of Finserv organizations (traditional and disruptive) for media buying and customer acquisition, but we also deeply understand the sales cycle. We put our own employees on the frontline calling prospects and we learn very quickly what motivates a Finserv customer to take action, qualifying and transferring over 250,000 leads / month.

Ready to learn more? Contact us today or download this white paper to learn about what it takes to become a Digital Economist.

NewHomeGuide.com doubles lead volume while improving conversion rate by 124%

NewHomeGuide.com is an industry leading resource for home buyers searching for new home developments. As the industry and consumer preferences shifted from print to digital, NHG knew they had to adapt in order to maintain their prominent position in the market. After investing in a strategic website launch to grow their digital presence in 2017, we were selected by NHG as the digital marketing partner to optimize their acquisition strategy via SEM and CRO.

“What has been most impressive is LQ Digital’s ability to be agile and drive changes at a speed that we weren’t driving internally. I have tapped into marketing experts that continuously strive for high performance to improve our digital acquisition and are aligned with our growth. I look forward to our next phase: which is driving even higher quality that results in even more impact for our clients.”

– Ashley Arnall, VP of New Homes

Download the case study and learn more about:

- How NHG doubled lead volume while reducing CPL by 68%

- The benefits of optimizing your marketing spend across channels to achieve your business KPI

Sun Basket Increases Subscribers Through Paid Search and Affiliate Marketing

Sun Basket is the leading healthy meal delivery service focused on fresh, sustainable, and organic ingredients with recipes catered towards customers on specific diets. We are proud to partner with a brand like Sun Basket in an emerging subscription economy category to help them expand their business. Sun Basket’s data-centric culture when it comes to designing recipes aligns well with our data-oriented approach when we drive digital acquisition strategies for our clients. We are excited to continue this partnership to help Sun Basket dominate in their market!

“LQ Digital’s focus on customer profitability and lifetime value is second-to-none. They are a trusted partner and I recommend that anyone looking to drive aggressive growth, but with a mindful eye on the relationship of acquisition cost and customer value, should engage now with LQ.” – Amy Endemann, Head of Marketing at Sun Basket

Download the case study and learn more about:

- How Sun Basket drove significant subscriber growth while decreasing cost per acquisition (CAC) by 13%

- How to tap into customer insights to invest in acquisition strategies that attract your most profitable customers

- How subscription-based brands should consider affiliate marketing as a strategy to supercharge acquisition

Digital Advertising Doesn’t Always Work (But It Can!)

This post is bi-lined by Christina Martin, Executive Director, Real Estate Marketing at USAA and a seasoned Digital Marketer with over two decades experience in financial services, including roles at Moneygram, United Capital Financial Advisors, and First Horizon Home Loans/First Tennessee (MetLife Home Loans). She shares her perspective here from speaking at Leads Con 2017 in a session entitled: From Search Campaign to Lead Qualification & Transfer – Using Data Analytics to Drive Volume. USAA is a LQ Digital client.

It may be time to take a different approach to avoid spending budget on wasted leads

It’s no secret that digital advertising has been steadily on the rise for a number of years now. In eMarketer’s latest quarterly projections for 2017, digital ad spend in the U.S. alone will grow by 15.9 percent to a whopping $83 billion in total revenue. Of course, it should come as no surprise that Google and Facebook continue to dominate this space, commanding 60 cents of every dollar spent.

These trends don’t show any signs of slowing, even as more marketers turn their attention and budgets to mobile advertising. In fact, the digital advertising industry is about to set a new milestone: by 2018, digital ad spend will surpass TV ad spend for the first time – and continue growing. That shouldn’t be news to marketers. The time to take action was yesterday; just look at the data. As digital continues to pull share away from TV, there’s no question that it should make up a big part of any marketer’s media plan in the year ahead. This basically means that the way we approach, plan, and execute digital advertising campaigns needs to fundamentally change if we expect to break through the noise and connect in a meaningful way with all-too-easily-distracted digital-first consumers.

So, given the relentless rise of digital ad spend, your knee-jerk reaction may be: “we must spend more to reach more consumers.” Generally speaking, you wouldn’t be wrong in making this assumption, but, in doing so, you are missing a big piece of the puzzle. Sure, by spending more on digital advertising, you will undoubtedly get a leg up on the competition in terms of overall impressions. But just because you reach more consumers doesn’t necessarily mean you’re reaching the right customers with compelling messages that motivates them to buy into your brand’s value proposition and eventually become actual customers. The problem here isn’t your spend; it’s how you’re spending your advertising dollars as well as what you’re doing to engage your target consumers.

Consider this a myth busted: greater spend doesn’t mean more positive results. If anything, it just gets you a lot more wasted leads and wastes your precious marketing budget. Industry-wide, it’s not all that surprising anymore to run into situations where, say, only eight percent of leads generated by a digital advertising campaign actually convert into something more substantial. When you do the simple math, that means the remaining 92 percent of those leads are basically useless or, in other words, deliver no value whatsoever. And in spite of the fact that many brands oftentimes see little return on their advertising spend (ROAS), they continue to pour more budget into advertising in hopes that the tables will eventually turn in their favor. It’s a nice idea, but, quite frankly, the wrong approach.

Additionally, it’s important to remember that digital advertising is not linear, nor is it executed via a “black and white” strategy either. ROAS in one channel may have a residual and beneficial impact in another, especially as ad spend grows. Social advertising is a great example of this. A recent Facebook study conducted with Nielsen Total Ad Ratings found that marketers who use Facebook ads to complement TV their ad spend can “boost audience reach and enhance the efficiency of their campaigns, particularly among younger audiences and light TV views.”

What’s the big takeaway here? It’s about time marketers got smarter about how they use (read: not spend) their digital advertising budgets. Here are a few pitfalls to avoid. First, ads need to be placed in the right channel. We know that all consumers are not created equally; digital advertising platforms aren’t either. Placing an ad in a channel that either fails to reach the right consumers or doesn’t incite the kind of action you need from them is a big waste of your budget. Don’t place ads on “popular” platforms just because they cater to a large audience. If your target consumers don’t spend their time there, you shouldn’t either.

Second, once you figure out where your target consumers spend their digital time, you still have to crack the code on how to speak to them – at least, in a way that gets them to act. Simply put, your message needs to resonate. Here’s some good news: practically every part of your digital advertising campaign can be optimized in real-time. Unlike that TV spot or static billboard you have running, you can test multiple digital ad units at the same time to see what works and cut out what doesn’t, instantly. Playing the digital advertising game is more than just purchase, create, publish, and wait. Every step in that process can be refined non-stop to drive results. Don’t just sit around until a campaign ends. If your message isn’t resonating, change it. The longer you run an ad with a mediocre call-to-action, the more budget you waste. Simple, right?

Lastly, if part of your digital advertising effort involves asking consumers to fill out a form to get more information, then be ready to get them that information immediately. Don’t make them wait. This isn’t dating. There’s no reason to be coy, but you shouldn’t stalk either. If you ask consumers to fill out a form for more information, only ask questions you absolutely need them to answer in order to make initial contact with them. If part of that information includes them giving you their phone number, then pick up the phone and call them back immediately. Doing so in less than one minute after receiving an inquiry can more than double conversion rates. Unfortunately, this is all too often where leads go to die. You’ve succeeded at getting consumers through the funnel to a point where they give you their contact information, only to keep them waiting. You’ve placed an ad on the right channel with the right message. Don’t lose that momentum while you’re already ahead.

If you’re following where I’m going with this, be sure your digital advertising spend is less about generating more leads and more about generating the right leads. This may be a lot to grasp at first because we’ve all become accustomed to measuring success through volume-based “vanity metrics” (more leads, more clicks, more impressions). Unfortunately, volume rarely equates to ROI. Why? Think of it this way: what’s the point of generating hundreds of leads if none of them actually convert? (Hint: it’s a waste of time and budget!)

Brands need to refocus their digital ad budgets on targeting only the most profitable customers or, more simply, the consumers who will generate the greatest overall lifetime value. There’s plenty of data and insights available to pinpoint and find the exact consumers we want to reach. So, in all honesty, knowing what resources are available to us to ensure every digital advertising campaign we run gets us closer to our most desired and relevant consumers, it seems silly that we’re still talking about wasted leads today. With the right planning, it’s avoidable.

To bring this idea around the “profitable customer” to life, I’m going to use an example from a talk I gave at LeadsCon Las Vegas earlier this year. USAA worked with LQ Digital to test paid search performance for a campaign effort intended to help veterans to purchase a home using their VA loan benefit. The goal was to reach VA-eligible veterans who weren’t already USAA members in a cost-effective way. So, that’s what we did – and LQ made it possible to track leads at every stage of the funnel, from initial search to loan purchase, to help us understand if we were, in fact, reaching the right customers at the right time.

Fortunately, we know a lot about what our members care about most and, from past campaigns, have learned what converts the best whenever we’ve got a new offer to share. For this campaign specifically, we worked with LQ to create a number of assets, from paid search ads to landing pages, that we knew would generate both interest and a response. Given the intensity and time-sensitive nature of this kind of purchase, we knew that adding things like call-back phone numbers on search ads (desktop and mobile) and providing a form to fill out on the landing pages would be most effective.

Here’s an interesting curveball (but something you should ultimately see less as a curveball and more like a best practice). Although the foundations of this campaign were built almost purely on digital, the magic really happened when a customer picked up the phone. During the run of this campaign, we saw the majority of qualified leads come from click-to-call (CTC) inbound mobile calls. These drove the highest conversion rates – more than desktop and mobile clicks – as well as a lower overall cost-per-lead (CPL). Additionally, of those consumers who clicked through and filled out the inquiry form on the landing page, our member service representatives were standing by to call them back immediately. Who knew that using online to drive offline conversion would be such a success?

Long story short: a solid digital customer acquisition strategy isn’t necessarily digital-only. Digital advertising alone is effective at getting the right consumers into the purchase funnel; a real conversation can move them through the funnel. Mobile CTC conversion rates alone speak volumes about the impact real human-to-human interaction can make to close a sale or win a new customer. Never discount the phone; it could be your greatest lead conversion asset.

To wrap this up, it’s safe to say that digital advertising isn’t really effective unless you:

- Know your target audience (“profitable customers”)

- Understand where they spend their digital time

- Develop (and test) messages that resonate most

- Be ready to pick up the phone when they call or make an inquiry

- Track and measure ROAS at every stage of the campaign journey

While this may seem like a simple recipe for success, many brands still make a number of avoidable missteps that ultimately lead to waste – wasted budget, wasted leads, wasted effort. Digital advertising can work hard for your brand as long as you take the time to set your campaigns up for success.

Digital Advertising on “Autopilot”

Has the growing Google-Facebook duopoly made marketers complacent?

Talk to any marketer. Ask them about how they plan to execute their digital advertising strategy. If the first words out of their mouths aren’t “Google and Facebook,” I’d be shocked.

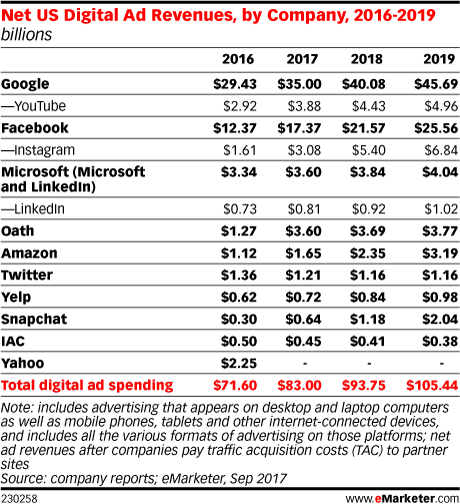

First, let’s look at the facts. For most of this year, we thought that Google and Facebook combined would end up dominating 60 cents of every dollar of the digital marketing ecosystem by the end of 2017. Then, in September, eMarketer dropped this little bomb:

a bit of a jump from the firm’s earlier projection of 60.4 percent. In terms of dollars, this means Google will earn about $35 billion in revenue while runner-up Facebook will claim a $17 billion piece of the pie. Chump change, really.

And while a mere three percent increase over estimate may seem like a drop in the bucket – since Google and Facebook own such a big chunk already – there’s a little more to this story: more digital marketing dollars are, almost by default, getting funneled into this behemoth of a duopoly. Let’s think about why. Both media companies are, for better or worse, mass-market darlings. They have successfully carved a (massive) niche for themselves that basically appeals to everyone. And let’s face it, Google more or less owns the territory of search – it earned its crown the minute the company’s namesake became a bonafide verb – and Facebook is widely seen as the social network. Safe to say that neither company has much of an identity problem.

Even though some have tried to suggest that a race is on to claim the third spot – because who doesn’t love the rise of an underdog? – the reign of Google and Facebook over the digital marketing economy is really far from over. Sure, we’ll see Oath, Amazon, Microsoft, and Snapchat try to steal their fair share of digital marketing dollars, but, until there’s a real paradigm shift, we might as well consider this competition more a “crawl” than a “race.”

Objectively, it would seem logical to say that it makes the most sense to spend more digital marketing dollars on platforms where more consumers go – even more the case if your focus is all about volume (i.e. getting your marketing message in front of more consumers). By all means, go for it. Both platforms give you instant access to billions of consumers.

But massive reach alone is really only part of the equation. You actually have to know how to put that massive reach to work for your brand. That comes down to data (big surprise here), but on a couple of fronts. First, both Google and Facebook have done a lot of the heavy lifting to analyze practically every interaction that takes place on their platforms. The end goal: to help brands target the right people with the right message and with the right creative at the right moment when they’re most likely to take action. From optimizing advertising messages to identifying even the most nuanced consumers behaviors – across desktop, mobile, and, you might even say, beyond – and literally everything in between, both platforms are mastering the art of targeting and conversion. The fact that both Google and Facebook can take out a lot of the guesswork when it comes to targeting, reaching, engaging, and converting a massive amount of consumers is the main reason why both platforms continue to get so much investment. The bottom line is: we trust their science.

There’s another side of this coin, however – and it relies a lot on how well you understand, with precision, the audiences you want to reach through your digital marketing efforts. To put it bluntly, if you want these platforms to generate some serious results for you, you actually have to know who your customers are: their digital behaviors, what they search for, where they shop, what drives them to action, and beyond. The only way to achieve this is by having a crystal clear picture of who your target customers are. A good place to start is by using your own data, along with other third-party or partner data, to create highly-targeted and brand-relevant audience profiles. With this information in place, the real magic can happen – on Facebook, Google, and across the entire digital marketing ecosystem.

It’s no secret that both Google and Facebook have doubled-down on their respective audience targeting efforts to help brands better optimize their own audience insights. From Google’s Similar Audiences and Customer Match advertising products to Facebook’s Lookalike Audiences and recently launched Value-Based Custom Audiences targeting solutions, it’s now possible to take your own CRM data to target and reach potential new customers who look and act a lot like your actual customers. Why this is important? Your current customers are your customers for a reason. Somehow you’ve created a connection with them – through your brand story, marketing messages, products, services, and so on. So, the assumption being made by both Google and Facebook is that consumers with similar demographics, behaviors, and interests to your very own are more likely to convert into new customers. And this is precisely what makes both platforms so attractive to marketers. They provide brands with instant access to billions of consumers that can be sliced and diced into any audience segment imaginable – more importantly, those that are likely to buy.

Here’s where the ball gets thrown back into your court. Simply finding these highly-likely-to-convert customers is only half the battle. You’ve got to take everything you’ve learned by wooing your actual customers and turn it into hyper-relevant creative and messaging that will get them over the finish line for your offer. And if you’ve used the tools available by both Google and Facebook successfully, your approach for engaging your target consumers should be anything but one-size-fits-all. I’ve said it before, and I’ll say it again: not all consumers are created equal. The way you engage them through digital marketing shouldn’t be either. If you’ve paid any attention to the customer data available, done the due diligence to create your own audience profiles, and used that information to build highly targeted audiences on both platforms, the only thing left to do is to engage and convert.

Unfortunately, this is where I feel things start to go on “autopilot.” I think we’re all so in awe of the infinite scalability of both Google and Facebook that we, as marketers, have started to see them as the de facto platforms for digital advertising success for that reason alone. Their unbalanced share of the market is indicative of this. But let’s face it, scale and reach isn’t marketing; marketing is just as much about finding our target consumers (the science) as it is about engaging them in relevant ways (the art). The predicament I think we’re in right now is that we’ve become too preoccupied with “finding” and surprisingly complacent when it comes to “engaging.” It almost begs the question: has data become a crutch?

Let’s face it, data is king – and there are very few marketers out there who would argue otherwise. Data tells us who are customers are. Data informs how we target and find them with utter precision across the digital world. Data also helps validate the effectiveness of our marketing efforts with measurable results. Even so, it doesn’t change the fact that your product, your offer, your message, and your creative strategy all still need to be strong. Winning in the digital advertising game requires winning at every step along the entire customer acquisition process. One weak link is all it takes to unravel an otherwise successful campaign.

Long story short, there’s good reason why Google and Facebook dominate the digital advertising marketplace: they give us access to a massive amount of data to better optimize our customer acquisition efforts and can provide plenty of evidence to support the value they bring to brands. This isn’t a trend that’s going away anytime soon. If anything, both Google and Facebook will only continue to get stronger. And as those platforms get more sophisticated, our approach to digital advertising strategy needs to evolve as well. Unfortunately, as an industry, we’re not quite there yet. However, as we continue to play catch up, let’s not let the celebrity-like allure of this duopoly cause our digital advertising efforts to go on “autopilot.”

Download the Case Study

Download the Case Study Download the Case Study

Download the Case Study