Watch the Webinar: Get Your SEO in Order

Throughout the Coronavirus pandemic, marketers are being asked to do more with less. Many of us are finding that our budgets are being cut and sometimes that means cutting back on advertising, such as paid search and social. However, there are still many digital strategies and programs that you can control and even improve, including your SEO strategy.

Now is the perfect time for marketers to review, clean and improve the SEO for their business. In this week’s 15 Minute Digital Planning Webinar, we interview our Director of SEO, Jacob King to identify the key strategies marketers can implement right now to improve their SEO strategy, such as:

Focusing on the structural content on your website and ensuring pages are visible to search engines so they’re easy to find.

Focusing on the structural content on your website and ensuring pages are visible to search engines so they’re easy to find.- Adding structured data (events) when possible. This is especially useful for industries that have traditionally used events or in-person meetings for their business, such as realtors.

- Re-purpose well performing secondary content such as how to guides, blog posts, e-guides and webinars.

- Link content sufficiently from higher profile pages, such as footers or headers on your home page to pass on link equity.

In the webinar, we’ll also cover how some industries are creatively solving for their needs now and building SEO to benefit their business in the future using creative tactics such as virtual events and much more. Watch the webinar for free:

At LQ Digital, we’ve captured a lot of data over the last 15 years on what scores as best-in-class digital performance (search, social, affiliate). At this time we want to contribute by sharing our data, knowledge and expertise to help your company survive this turbulent time and provide relief.

Remember to subscribe to our webinar series so you always have the latest news and insight in your inbox: subscribe here.

15 Minute Digital Planning Webinar: Paid Social in the Time of Coronavirus

We understand this is an extremely challenging time – but your business doesn’t have to come to a screeching halt. In fact, businesses and consumers still need supplies & resources – their needs are just shifting and they’re moving almost exclusively to digital channels.

Now is the time to take action, be nimble to that shift and shore-up your digital strategy. We want to be your ally. As our contribution to help during this crisis, we are kicking off a series of webinars focused on survival strategies, insight and practical tips from our own digital experts as well as partners. Each week, we’ll host a 15 minute webinar (give or take) with rotating topics, to help you navigate these strange times we’re finding ourselves in.

In the first episode of our webinar series we interviewed our own VP of Display & Social, Greg Allum for our Paid Social: Part 1 Edition. We gathered his perspective on the impact Coronavirus has had on Paid Social and what companies can expect moving forward, such as:

- How Coronavirus is impacting social usage & engagement

- How marketers are currently responding to the crisis

- How advertising during a recession can actually help businesses

- The importance of creative & messaging

At LQ Digital, we have over 15 years of digital media, strategy & data management experience and have deep expertise in working with clients in B2C subscription, mortgage lending, B2B, Real Estate, Personal Loans and so much more. As such, we’ve captured a lot of data on what scores as best-in-class digital performance (search, social, affiliate). At this time we want to contribute in the only way we know how, to share our data, knowledge and expertise to help your company survive this turbulent time and provide relief. Please watch the webinar for free here:

Digital Survival Guide Webinar: Paid Social, Part 1

Still have questions or want a us to cover a particular topic? Email us at ehoffman@lqdigital.com and remember to subscribe to our webinar series so you always have the latest news and insight in your inbox. Subscribe here.

Customer Acquisition for FinTech – The David and Goliath Story

Make sure you bring the right sling

By Patrick Wang, Chief Digital Economist, LQ Digital

It seems like every day you hear of a new Fintech startup entering the market with a better mousetrap. New technologies from Google and Facebook have allowed disruptors to reach customers directly, blockchain has created new ways to underwrite contracts, and emerging mobile and data techniques are changing the way companies can deliver financial services quickly and at lower cost to the consumer. Like the David, their ability to strike where it matters have allowed them to exploit chinks in the armor of large traditional financial services companies.

Despite the interest and hubris of all Fintech disruptors however, Fintech companies would be wise to respect that Finserv incumbents are still Goliath’s in the space and for good reason. Challenging them in the wrong way will lead to certain defeat as they can be crushed by their sheer mass and resources. Banks and other financial institutions have spent the better part of a century consolidating and monetizing the value of each customer they capture. They can afford to take a loss on an initial transaction so that they can ultimately cross-sell customers into other services.

Take for example: JP Morgan Chase. After 100+ years rolling up Finserv offerings – they can afford to acquire checking and savings customers at a loss – by creating an engagement vehicle to market a full line of financial services from mortgages, home equity, unsecured loans etc, and vice versa for other product lines.

In contrast, a Fintech disruptor like LendingClub started out tackling personal loans with a best of breed solution – offering quicker funding, better rates, and ease of service based on novel capital sources and new lending risk models. An attractive value proposition on its own, but is it enough to build a competitive business in a room filled with giants?

What’s the Problem?

The challenge for all Fintech disruptors trying to grow profitably is this:

They must be surgically precise about the profile of financial customers they are looking to acquire because:

- Large incumbent banks have had the luxury of being less precise with their customer acquisition strategy because they offer a full line of services (they can bring everyone in and offer something of value)

- Copying a large bank’s broad go-to-market will lead to Fintech disruptors depleting their limited growth budgets, while quickly finding out that they can’t service many of those customers profitably.

Making a hard problem harder is U.S. financial marketing compliance.

- U.S. Fair Lending regulations restrict targeting consumers by many of the dimensions that can signal customer value to a Fintech disruptor. With this constraint, many Fintech companies are quickly forced down a path where they find themselves in a crowded acquisition market with not one, but two or three large incumbents with little room to maneuver.

Fintech disruptors have much less room for error when it comes to acquiring customers.

- Large banks have large balance sheet and an already established portfolio of customers to lean on, so they are insulated from customer acquisition investments gone bad. A fintech disruptor has less margin for error as a bad bet can submarine their growth.

The margin for error continues to erode.

- Cost per clicks (CPC) continue to rise year over year as the competition for growth continues to increase with both traditional finserv and fintech companies going after the same fixed pools of interest.

Bringing a Sling to the Customer Acquisition Melee

What does success require a Fintech disruptor to stand a chance and not get crushed by exorbitant CPC’s, locked up lead marketplaces, and loss-making acquisition?

- Having a clear sense of the specific customer profile where they have an unfair advantage of converting customers.

- Knowledge of both new and old pathways to financial customers and who the customer brokers are in those spaces. Knowledge of these go-to-market channels allows Fintech companies to comply with regulation and at the same time target and segment their customer acquisition.

- A detailed and precise instrumentation of their sales cycle tied to the marketing channels that drive acquisition so that they have confidence in the acquisition investments they are making in advance of revenue.

Why Partner and Why Now?

- Diversity of Skills – Few individuals and organizations have the diversity of skills needed to be a successful all-in-one team (e.g. data science, media buying, conversion design and tech, messaging, etc.). It’s a multi-disciplined approach that requires skills from scrappy startups and knowledge of the “old world”.

- Data Capture / Benchmarking – Success requires capturing as much data as quickly as possible and then comparing those to 3rd-party benchmarks on channel performance. With access to this data, Fintech disruptors can quickly assess – is it our offering? Or is it the customer? Having a partner that’s worked with many other Finserv companies allows you a unique perspective on “what’s to be expected in the space”.

- Measuring Segment Unit Economics (performance from marketing KPIs down to LTV) – Calculating the potential likely future revenue / profit from each lead source or type is critical to helping you direct today’s media spend towards the channels and conversion strategies that will deliver the most revenue and profit, at the lowest marketing cost. Expertise in knowing how to implement accurate data tracking from marketing platforms to your CRM, and then analyzing that data, can be a difficult to find internally in fast-growing startups.

- Time to Market – Once a fintech disruptor’s offering is in market, the clock is ticking. Competitors have a chance to observe and replicate many of the valuable aspects of their offer. Having established relationships with publishers and lead brokers allow companies to accelerate their growth and not stumble over many of the common pitfalls in the industry.

Why LQ?

In short – we have all of the ingredients for Finserv acquisition success.

- For LendingClub we managed media against a cost per issued loan. (So we built data precision on how media turns into revenue, and built markers earlier/higher up in the funnel that signaled which leads were more likely to turn into revenue).

- For one of the largest multi-national financial services institutions, we helped them optimize their Direct to Consumer mortgage channel, accelerating their time-to-market by 1) short-listing the lead partners to work with, 2) rapidly stand up those relationships, and 3) optimizing each relationship against a cost per funded loan performance metric leveraging performance data captured through a lead conversion process we managed.

- For SmartBizLoans, we are able to target the specific profile of small business owners who can both credit and revenue qualify for their loans. (So we know precisely how to target serviceable customers).

Not only has LQ worked with a large portfolio of Finserv organizations (traditional and disruptive) for media buying and customer acquisition, but we also deeply understand the sales cycle. We put our own employees on the frontline calling prospects and we learn very quickly what motivates a Finserv customer to take action, qualifying and transferring over 250,000 leads / month.

Ready to learn more? Contact us today or download this white paper to learn about what it takes to become a Digital Economist.

Don’t Forget About Conversion Rate Optimization

Why the most overlooked part of digital marketing is actually your most powerful tool

You’ve built a brand. You’ve taken the time to develop your website and digital presence. You’ve crafted an SEO strategy. You’ve identified your target audience – aka, your most profitable customers. You’ve created a unique message to resonate specifically with that audience and haven’t wasted a single minute getting that message out there via digital advertising. Right now, you’re probably thinking that you’ve got everything moving full steam ahead – and, in many ways, getting this far puts you way ahead of the curve. But there’s one part of this digital marketing equation that you’ve probably overlooked: conversion rate optimization.

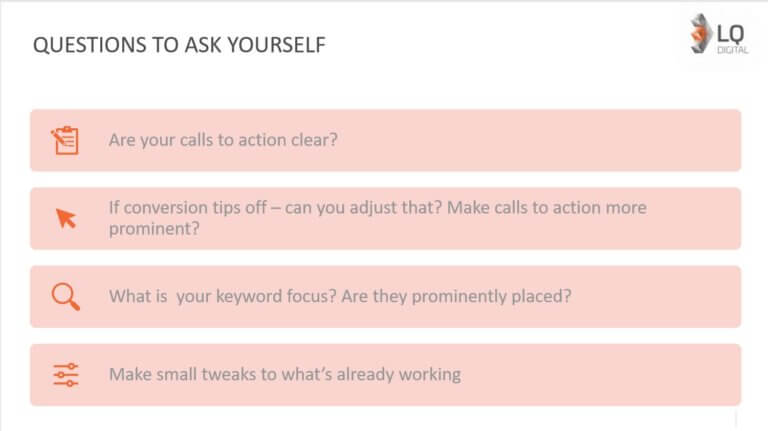

Defined as the art and science of getting people to act once they arrive on your website, conversion rate optimization is, more or less, the operational side of digital marketing. It’s not as “sexy” as all that outbound, creative work you’ve been doing to build the side of your brand that your customers see. However, what you may not realize is that conversion rate optimization can actually make a huge impact on how you grow. It provides insights into which of your marketing tactics – on your website and via digital advertising – are driving your business goals forward versus those that are underperforming. So, in essence, conversion rate optimization can make all of your marketing efforts a lot more effective.

Why then, in spite of all the clearly defined benefits of conversion rate optimization, does it tend to be the forgotten part of digital marketing? One of the biggest reasons is because it’s hard work. For all intents and purposes, it’s purely scientific. You create a hypothesis. You test that hypothesis against a control. You measure the effectiveness of both variables over a period of time. You draw conclusions from that test and then implement changes on your website or in your digital advertising efforts based on what proved to be most effective. And then, you start that process all over again with a new hypothesis.

This essentially means that the work of conversion rate optimization is never really “done.” Sorry, you don’t get instant gratification. It requires time and patience. The very ongoing nature of conversion rate optimization can feel daunting because there is a never ending number of factors to test – and in various orders – to see how your can maximize the effectiveness of your digital presence. And while each test is an opportunity to learn something new, sometimes the end result doesn’t even support your initial hypothesis. But you have to embrace this ongoing test-measure-repeat cadence to see how even small changes can drive serious performance gains (i.e. doubling conversion rates). With conversion rate optimization, you have to trust the data because data doesn’t lie – even if your creative sensibilities hoped for a different outcome.

Another reason why conversion rate optimization doesn’t always see the light of day in many organizations is due to a lack of alignment between the marketing and tech teams. Simply put, marketing must convince the tech folks – who typically have the final decision – to buy into it and actually agree to allocate resources to support it. The challenge is that the tech team has its own priorities, which likely have nothing to do with increasing conversion rates. When it comes to your brand’s website, what only matters to them is whether it’s working or not. “If it’s not broke, then don’t fix it” is typically the mentality of a task-focused tech team. All those little, never-ending, and time-consuming iterations that you need them to deploy and manage can be easily perceived as a massive headache in the making. So, it’s no surprise that convincing them on this front can feel like an uphill battle.

But, as a marketer, conversion matters to you because you know that being able to convert more leads into actual customers is the best way to deliver long-term business value through marketing. It’s also the most measurable way to demonstrate the success of your marketing efforts. After all, conversion rate optimization can make all those results stronger. But you can’t do it all on your own. You need strategists to come up with a non-stop supply of hypotheses, design support for all those iterations you’re testing, the ability to deploy and test new variables quickly, as well as the data to help you see what’s working. So, when you can’t get the support internally, it’s a massive roadblock to results.

We know this at LQ. That’s why we’ve taken an entirely different approach to conversion rate optimization. We know just how important it is for brands to do this kind of work. So, to help ease the pain, we oftentimes offer our expert services on a pay-for-performance basis. Not only is this a huge incentive for us to help brands drive real performance gains – which is what we love to do most – but it’s one way we can demonstrate how we “talk the talk and walk the walk.” This is one of the biggest reasons why Microsoft Bing named us “Optimizer of the Year.” We challenge ourselves every day to take new approaches to conversion rate optimization to help our customers create a better and more compelling brand story. It may seem like the “blue collar” work of digital marketing, but it’s not really; it’s just as important – if not more – than all of your other marketing tactics. We know the large rewards that stem from it. If you want to learn more about what it entails, we’d be happy to help.

Long story short: if you think you’re doing everything possible to reach, target, and engage prospects and eventually turn them into loyal customers, there’s a good chance you’ve missed the most critical part of the digital marketing equation: conversion rate optimization. Sure, it’s not the sexiest, but it delivers real, measurable results and makes all that sexy and fun creative work you do more effective in the long run. After all, why invest in your digital presence if you aren’t willing to take the time to make it as strong and effective as it can possibly be?

In Search of the Elusive “Profitable Customer”

Marketers should stop counting leads and shift their focus to Lifetime Value (LTV)

Not all customers are created equally.

Some stumble upon your brand, drop in to test out your product or service, and maybe make a small purchase – only to never come back. Others are instantly enamored by your offer, build a connection with your brand, and quickly turn into customers for life. It’s hard to say which path a new visitor to your business will take if you’re simply casting a wide net with your marketing efforts. Hoping that a few of your new “leads” stick around leaves a lot to fate and can quickly drain whatever marketing budget you have.

All too often I hear marketers throw around “leads generated” as a success metric worth bragging about. While it might be a good indicator of the overall impact of a marketing campaign, it fails to deliver on your real business objective: driving profitable growth by increasing your long-term customer base.

Besides, a lead is not an actual customer. It’s merely the potential for someone to become a customer. At that point, the ball is in your court to make that lead believe in your business. That takes time, money, and valuable resources before that conversion ever happens – and when it does happen, there’s still no guarantee this new customer will continue coming back for more.

Consider Blue Apron’s lackluster story of going public. At the time of the IPO, the company claimed one million customers, but was still far from profitable. Why? Because many of those customers were still in the “trial” phase of their relationship with the brand. They were willing to give the meal kit service a shot, but not necessarily ready to commit to an ongoing subscription. Unfortunately, this assumption proved to be true, with the company now facing a surprisingly high estimated churn rate of 72 percent within six months. Add to that the cost of acquiring a new customer over the last twelve months, estimated at a whopping $460 per customer, and it’s becoming a challenge for the company to break even. This is a perfect example of leads not delivering long-term value. Blue Apron saturated the market with offers and promotions – from digital to direct mail – but that’s about as far as they got.

When this happens, you have to ask yourself, “Was this worth the cost?” The easy way to answer this question comes down to a relatively simple calculation of Lifetime Value (LTV)/Customer Acquisition Cost (CAC). If you aren’t at least breaking even, it’s time to rethink your overall customer acquisition strategy. To put this in context, the most sophisticated businesses regularly achieve customer lifetime value at three to five times the cost of acquiring a customer. This is where you want to be. It’s not sustainable to consistently have the scales tipped in the opposite direction.

Marketers have got to be smarter, savvier, and much more efficient when it comes to customer acquisition. They need to think like economists and operators, not like campaign managers and traditional marketers. They need to shift their focus from “generating leads” to “finding the right customers.” This means building a strategy that ultimately delivers long-term profitable growth.

As one client recently said to me: “I’m moving from a cost center to the revenue team.” That’s the spirit! Your business objective is to be profitable. As such, your marketing team needs to deliver more than just new customers; it needs to deliver great ones. Unfortunately, it’s hard to achieve that goal if you don’t stay laser-focused on earning the loyalty of “profitable customers.” Mind you, the responsibility for this doesn’t just sit within marketing or sales. The customer must be at the heart of every business decision made, from the Board of Directors down.

The truth is, customer acquisition is a lot like matchmaking. You should be looking for the right fit, not just the right now. Obviously, your end goal is to have as many potential customers as possible “swipe right.” But when they do, you have to be ready to get that relationship going. This is what drives customer lifetime value. So, given the choice between volume and value, wouldn’t you rather spend time, money, and available resources on building long-term relationships with the most profitable customers? (Your answer should be, “yes!”)