Watch the Webinar: Get Your SEO in Order

Throughout the Coronavirus pandemic, marketers are being asked to do more with less. Many of us are finding that our budgets are being cut and sometimes that means cutting back on advertising, such as paid search and social. However, there are still many digital strategies and programs that you can control and even improve, including your SEO strategy.

Now is the perfect time for marketers to review, clean and improve the SEO for their business. In this week’s 15 Minute Digital Planning Webinar, we interview our Director of SEO, Jacob King to identify the key strategies marketers can implement right now to improve their SEO strategy, such as:

Focusing on the structural content on your website and ensuring pages are visible to search engines so they’re easy to find.

Focusing on the structural content on your website and ensuring pages are visible to search engines so they’re easy to find.- Adding structured data (events) when possible. This is especially useful for industries that have traditionally used events or in-person meetings for their business, such as realtors.

- Re-purpose well performing secondary content such as how to guides, blog posts, e-guides and webinars.

- Link content sufficiently from higher profile pages, such as footers or headers on your home page to pass on link equity.

In the webinar, we’ll also cover how some industries are creatively solving for their needs now and building SEO to benefit their business in the future using creative tactics such as virtual events and much more. Watch the webinar for free:

At LQ Digital, we’ve captured a lot of data over the last 15 years on what scores as best-in-class digital performance (search, social, affiliate). At this time we want to contribute by sharing our data, knowledge and expertise to help your company survive this turbulent time and provide relief.

Remember to subscribe to our webinar series so you always have the latest news and insight in your inbox: subscribe here.

Google Shopping: Now Open to Unpaid Listings, Watch the Video

Last week, Google made a surprising announcement and opened up their Google Shopping platform to unpaid product listings. The move comes as many brick and mortar retailers were forced to close their doors (at least temporarily) due to the Coronavirus pandemic and may now be looking to more e-commerce opportunities.

So what does this shift mean for merchants? As part of our weekly webinar series where we highlight digital planning strategies to combat the Coronavirus pandemic, we interviewed VP of Strategic Accounts, Phil Strohl to better understand what this shift in Google’s offering means and how marketers can leverage this new opportunity.

Watch the quick 15 minute video above to uncover:

- What the Google Shopping opportunity means for existing Google Merchants and Merchants that have never used the platform.

- Where to get started if you’ve never used Google Shopping before and what to tackle first for the biggest advantage.

- Key recommendations to maximize the Google Shopping feature, such as: review & optimize product feeds and add products that may have been excluded previously due to a low Return on Ad Spend/margin.

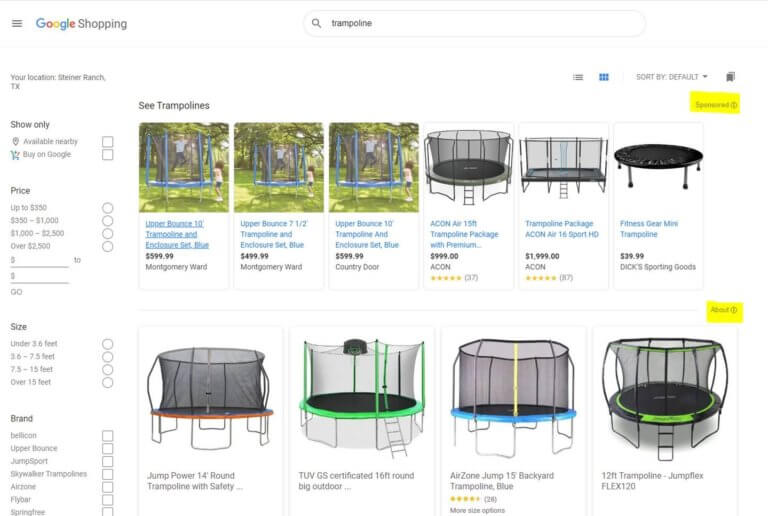

The new experience is live on Google Shopping. Separate “Sponsored” and “Organic” results sections highlighted.

At LQ Digital, we’ve captured a lot of data over the last 15 years on what scores as best-in-class digital performance (search, social, affiliate). At this time we want to contribute by sharing our data, knowledge and expertise to help your company survive this turbulent time and provide relief.

Still have questions or want a us to cover a particular topic? Email us at ehoffman@lqdigital.com and remember to subscribe to our webinar series so you always have the latest news and insight in your inbox: subscribe here.

15 Minute Digital Webinar: Make Paid Search Work for You

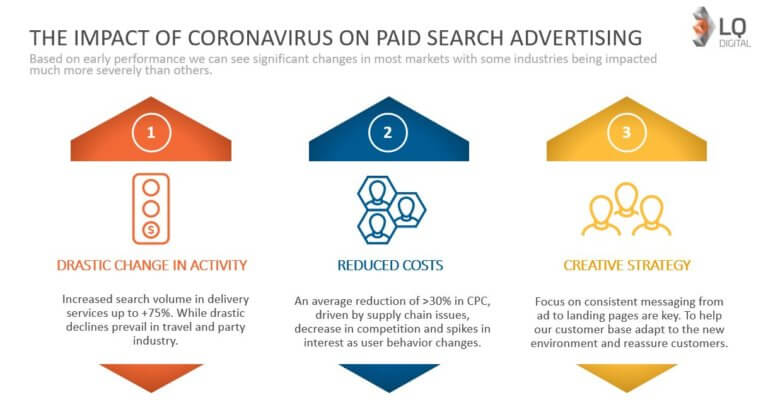

The Coronavirus pandemic has impacted nearly every industry and as such, marketers are juggling multiple challenges. As the financial arms of companies start to intervene and make more of the larger business decisions, marketers are finding that their budgets are slashed and as a result, are having to do more with less. So how can marketers reach new customers in such uncertain times and more importantly, how can they optimize and ensure the investments they DO make are making an impact on the increasingly important bottom line?

As part of our weekly 15 Minute Digital Planning Survival Guide webinar series, we interviewed Monica Niblack, VP of Strategic Accounts at LQ Digital to better understand how the pandemic has impacted Paid Search, what marketers should be paying attention to and steps they can take to improve their efforts.

Learn how to make Paid Search work for you and even uncover new growth opportunities using strategic tactics, such as:

- Reminding yourself of the core of your customer acquisition strategy, so you can stay laser focused on your target segment, channel priority and creative – but also understand where to pivot. Instead of pausing all of your Paid Search efforts, now is the time to get really clean and strategic.

- Since media costs have fallen so quickly, it opens up opportunity to refresh old campaigns that could not meet previous profitability targets – so now is the time to take advantage of shorter, faster testing.

- Find new profitable growth areas with faster testing of the marginal economics and incrementality (vol / cost). This type of testing is vital right now. At LQ Digital, we’ve used this method to open up new revenue opportunities for clients that otherwise, would be more severely impacted during the shutdown.

- Continually re-verify and monitor your key profitability and conversion metrics all the way down your funnel to revenue. Depending on which stage you see performance changes, it can lead to different remedies to changing creative, target segments and bidding.

At LQ Digital, we’ve captured a lot of data over the last 15 years on what scores as best-in-class digital performance (search, social, affiliate). At this time we want to contribute by sharing our data, knowledge and expertise to help your company survive this turbulent time and provide relief. Watch the webinar for free here:

Digital Survival Guide Webinar: Make Paid Search Work for You

Still have questions or want a us to cover a particular topic? Email us at ehoffman@lqdigital.com and remember to subscribe to our webinar series so you always have the latest news and insight in your inbox: subscribe here.

15 Minute Digital Planning Webinar: Paid Social in the Time of Coronavirus

We understand this is an extremely challenging time – but your business doesn’t have to come to a screeching halt. In fact, businesses and consumers still need supplies & resources – their needs are just shifting and they’re moving almost exclusively to digital channels.

Now is the time to take action, be nimble to that shift and shore-up your digital strategy. We want to be your ally. As our contribution to help during this crisis, we are kicking off a series of webinars focused on survival strategies, insight and practical tips from our own digital experts as well as partners. Each week, we’ll host a 15 minute webinar (give or take) with rotating topics, to help you navigate these strange times we’re finding ourselves in.

In the first episode of our webinar series we interviewed our own VP of Display & Social, Greg Allum for our Paid Social: Part 1 Edition. We gathered his perspective on the impact Coronavirus has had on Paid Social and what companies can expect moving forward, such as:

- How Coronavirus is impacting social usage & engagement

- How marketers are currently responding to the crisis

- How advertising during a recession can actually help businesses

- The importance of creative & messaging

At LQ Digital, we have over 15 years of digital media, strategy & data management experience and have deep expertise in working with clients in B2C subscription, mortgage lending, B2B, Real Estate, Personal Loans and so much more. As such, we’ve captured a lot of data on what scores as best-in-class digital performance (search, social, affiliate). At this time we want to contribute in the only way we know how, to share our data, knowledge and expertise to help your company survive this turbulent time and provide relief. Please watch the webinar for free here:

Digital Survival Guide Webinar: Paid Social, Part 1

Still have questions or want a us to cover a particular topic? Email us at ehoffman@lqdigital.com and remember to subscribe to our webinar series so you always have the latest news and insight in your inbox. Subscribe here.

High-tech + Low-tech Growth Challenges for Mortgage Lenders

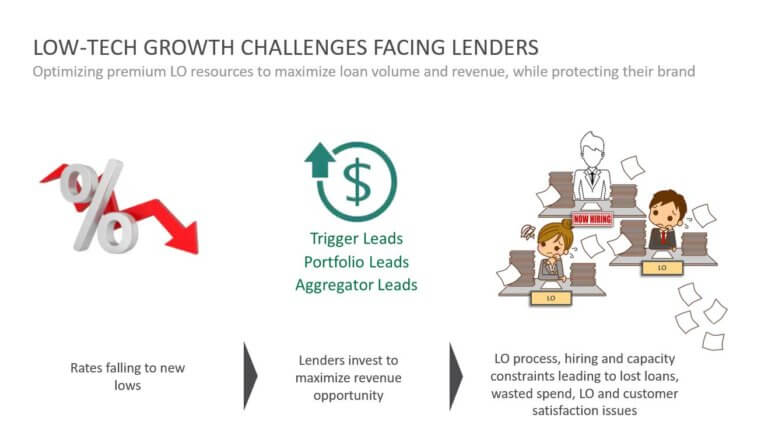

The mortgage industry has faced a number of challenges in recent years: technological advancements, increasing competition and lack of entry-level housing. All of which have added mounting pressure to mortgage lenders looking for growth and profitability. However, most lenders have also relied on low interest rates & the refinance boom to fuel their loan growth the last year or two. With new, well-financed lenders disrupting the market and the threats of higher mortgage rates and tighter lending standards in 2020 and 2021, leading lenders are starting to prepare for greater competition.

So how are lenders responding?

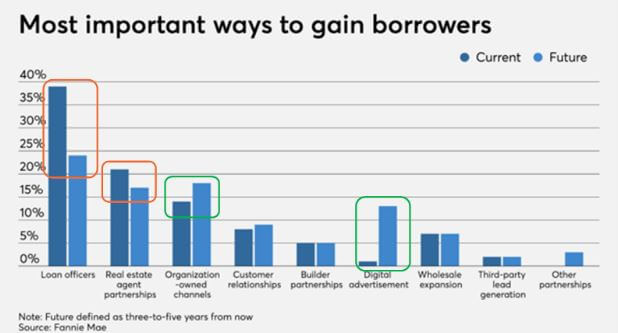

A recent article by National Mortgage News reviewing Fannie Mae’s Dec 2019 Mortgage Lender Sentiment Survey reports a majority of lenders are planning to fuel their growth over the next 3-5 years by diversifying where they source new loan leads. They will be adding to their traditional model of relying primarily on LO networks and RE partnerships, by dramatically increasing their investments to generate leads from digital channels (owned and paid). The goal is to help them generate more leads, particularly from the younger generation who favors mobile and digital engagement.

Interestingly, at the same time, additional articles from National Mortgage News have called out that despite this shift to more digital mortgages, Personalization still matters. Although more future customers will be researching more online, and looking for more efficient online options to streamline much of the borrowing process, it does not mean their journey ends behind a screen. When borrowing hundreds of thousands of dollars on a home loan, it turns out most people (even millennials) state that they prefer at some point to talk to a human being.

However, in the very low rate environment we have experienced for the last year, many lenders we work with are “jumping in” with increased budgets to take advantage of this great lending opportunity. The biggest operational hurdle many face is keeping enough loan officer capacity on line, and operating at optimal efficiency, to keep up with demand. Added hiring increases labor costs that eat away at margins, while hiring delays stall growth and reduce revenue. Finding ways to maximize the amount of existing loan officer capacity focused on closing loans (vs being distracted with qualifying or nurturing lower-quality leads), while increasing their efficiency at closing, is the virtuous cycle that generates maximum growth in closed loans units, revenue and profits.

However, in the very low rate environment we have experienced for the last year, many lenders we work with are “jumping in” with increased budgets to take advantage of this great lending opportunity. The biggest operational hurdle many face is keeping enough loan officer capacity on line, and operating at optimal efficiency, to keep up with demand. Added hiring increases labor costs that eat away at margins, while hiring delays stall growth and reduce revenue. Finding ways to maximize the amount of existing loan officer capacity focused on closing loans (vs being distracted with qualifying or nurturing lower-quality leads), while increasing their efficiency at closing, is the virtuous cycle that generates maximum growth in closed loans units, revenue and profits.

This blog reviews the best practices we have identified over 15 years to drive loan volume and revenue growth for both large traditional lenders and disruptive digital startups (across mortgages, HELOC, equity loans, educational and personal). These fall into two basic categories.

- High-tech (Digital Growth) strategies

- Low-tech (LO Efficiency) strategies

Strategy 1: Building a Successful, Modern Digital Growth Strategy

The digital native generation – millennials – are finally coming to market after years of postponing home ownership. So if you want to be profitable in the years to come there are 3 key principals we guide our marketing executive clients to think about and solve.

1. Separating KPIs from Economics

Too many marketers focus on upper-funnel vanity metrics (e.g. impressions, clicks, CTR, CVR) instead of translating and speaking at all times about their activity in terms of its bottom-line impact on growth metrics that drive their business (e.g. how many units were sold, at what unit value, at what CPFL or LTV/CAC). Only by refocusing on business growth metrics can a marketer judge and measure the true value of different growth strategies.

2. Full Funnel Visibility

Many lender marketers say they have this, but yet they cannot answer what is their current CPFL. This is because getting this data is hard. It is captured in multiple systems across both sales and marketing, which means it is typically not available to marketing (or if it is, it is not generated daily, but at most monthly) due to the complexity in pulling it together. The lack of having real-time data on the cost per unit sold (CPFL) prevents marketers from having the insights needed to guide media decisions to drive real bottom-line growth. Marketers are too often blind to the true economic impact of their decisions on the business, limiting their ability to delivery true growth.

3. Segments Before Channels

Once you have access to a real-time, full-funnel view into your marketing performance, you can use that data to then answer what are your highest-value target customer segments to prioritize (e.g. which generate higher LTV/CAC). By knowing what each segment is worth, and what they cost you, by channel, only then will you be armed to build the optimal media plan (across each channel) to maximize your total business growth at the lowest blended cost.

Our Feb 2020 webinar with Blend talks in more detail about how leading mortgage lenders can use these lessons to modernize their digital customer acquisition strategy to generate loan growth in 2020 and beyond (view the webinar here).

Strategy 2: Leveraging a Contact Center To Maximize LO Closed Sales

Over the last 15 years, our Contact Center Services have partnered in growth campaigns with clients operating in several complex, considered-purchase product environments (e.g. lending, real estate, education, B2B technology and B2C subscription services). In each we proved how strategically leveraging call center resources:

- Satisfied the personalization needs of the potential borrower.

- Created a positive customer experience that strengthened their relationship with the lender’s brand.

- Improved conversion rates by proactively engaging potential borrowers (e.g. loan app not completed) in a live discussion to accelerate their movement down the sales process.

- Qualified out leads that would not qualify for a loan or were not serious about applying today, before having them speak with a loan officer.

By strategically leveraging a call center team to offload some of this early-stage work otherwise left to LOs, the number of leads that can move through the sales process increases dramatically. This results in increasing closed loan volumes by maximizing the LO time spent closing qualified loan applicants – while simultaneously reducing the new LO hiring requirements to reach those higher closed-loan numbers.

Our whitepaper “The Power of the Call: Your Secret Weapon to Maximize Revenue and Reduce Costs” describes the specific methods for leveraging a Contact Center to help you maximize the loan-closing impact of your existing LO resources, improve conversion rates and reduce cost-per-lead (download the whitepaper here).

Customer Acquisition for FinTech – The David and Goliath Story

Make sure you bring the right sling

By Patrick Wang, Chief Digital Economist, LQ Digital

It seems like every day you hear of a new Fintech startup entering the market with a better mousetrap. New technologies from Google and Facebook have allowed disruptors to reach customers directly, blockchain has created new ways to underwrite contracts, and emerging mobile and data techniques are changing the way companies can deliver financial services quickly and at lower cost to the consumer. Like the David, their ability to strike where it matters have allowed them to exploit chinks in the armor of large traditional financial services companies.

Despite the interest and hubris of all Fintech disruptors however, Fintech companies would be wise to respect that Finserv incumbents are still Goliath’s in the space and for good reason. Challenging them in the wrong way will lead to certain defeat as they can be crushed by their sheer mass and resources. Banks and other financial institutions have spent the better part of a century consolidating and monetizing the value of each customer they capture. They can afford to take a loss on an initial transaction so that they can ultimately cross-sell customers into other services.

Take for example: JP Morgan Chase. After 100+ years rolling up Finserv offerings – they can afford to acquire checking and savings customers at a loss – by creating an engagement vehicle to market a full line of financial services from mortgages, home equity, unsecured loans etc, and vice versa for other product lines.

In contrast, a Fintech disruptor like LendingClub started out tackling personal loans with a best of breed solution – offering quicker funding, better rates, and ease of service based on novel capital sources and new lending risk models. An attractive value proposition on its own, but is it enough to build a competitive business in a room filled with giants?

What’s the Problem?

The challenge for all Fintech disruptors trying to grow profitably is this:

They must be surgically precise about the profile of financial customers they are looking to acquire because:

- Large incumbent banks have had the luxury of being less precise with their customer acquisition strategy because they offer a full line of services (they can bring everyone in and offer something of value)

- Copying a large bank’s broad go-to-market will lead to Fintech disruptors depleting their limited growth budgets, while quickly finding out that they can’t service many of those customers profitably.

Making a hard problem harder is U.S. financial marketing compliance.

- U.S. Fair Lending regulations restrict targeting consumers by many of the dimensions that can signal customer value to a Fintech disruptor. With this constraint, many Fintech companies are quickly forced down a path where they find themselves in a crowded acquisition market with not one, but two or three large incumbents with little room to maneuver.

Fintech disruptors have much less room for error when it comes to acquiring customers.

- Large banks have large balance sheet and an already established portfolio of customers to lean on, so they are insulated from customer acquisition investments gone bad. A fintech disruptor has less margin for error as a bad bet can submarine their growth.

The margin for error continues to erode.

- Cost per clicks (CPC) continue to rise year over year as the competition for growth continues to increase with both traditional finserv and fintech companies going after the same fixed pools of interest.

Bringing a Sling to the Customer Acquisition Melee

What does success require a Fintech disruptor to stand a chance and not get crushed by exorbitant CPC’s, locked up lead marketplaces, and loss-making acquisition?

- Having a clear sense of the specific customer profile where they have an unfair advantage of converting customers.

- Knowledge of both new and old pathways to financial customers and who the customer brokers are in those spaces. Knowledge of these go-to-market channels allows Fintech companies to comply with regulation and at the same time target and segment their customer acquisition.

- A detailed and precise instrumentation of their sales cycle tied to the marketing channels that drive acquisition so that they have confidence in the acquisition investments they are making in advance of revenue.

Why Partner and Why Now?

- Diversity of Skills – Few individuals and organizations have the diversity of skills needed to be a successful all-in-one team (e.g. data science, media buying, conversion design and tech, messaging, etc.). It’s a multi-disciplined approach that requires skills from scrappy startups and knowledge of the “old world”.

- Data Capture / Benchmarking – Success requires capturing as much data as quickly as possible and then comparing those to 3rd-party benchmarks on channel performance. With access to this data, Fintech disruptors can quickly assess – is it our offering? Or is it the customer? Having a partner that’s worked with many other Finserv companies allows you a unique perspective on “what’s to be expected in the space”.

- Measuring Segment Unit Economics (performance from marketing KPIs down to LTV) – Calculating the potential likely future revenue / profit from each lead source or type is critical to helping you direct today’s media spend towards the channels and conversion strategies that will deliver the most revenue and profit, at the lowest marketing cost. Expertise in knowing how to implement accurate data tracking from marketing platforms to your CRM, and then analyzing that data, can be a difficult to find internally in fast-growing startups.

- Time to Market – Once a fintech disruptor’s offering is in market, the clock is ticking. Competitors have a chance to observe and replicate many of the valuable aspects of their offer. Having established relationships with publishers and lead brokers allow companies to accelerate their growth and not stumble over many of the common pitfalls in the industry.

Why LQ?

In short – we have all of the ingredients for Finserv acquisition success.

- For LendingClub we managed media against a cost per issued loan. (So we built data precision on how media turns into revenue, and built markers earlier/higher up in the funnel that signaled which leads were more likely to turn into revenue).

- For one of the largest multi-national financial services institutions, we helped them optimize their Direct to Consumer mortgage channel, accelerating their time-to-market by 1) short-listing the lead partners to work with, 2) rapidly stand up those relationships, and 3) optimizing each relationship against a cost per funded loan performance metric leveraging performance data captured through a lead conversion process we managed.

- For SmartBizLoans, we are able to target the specific profile of small business owners who can both credit and revenue qualify for their loans. (So we know precisely how to target serviceable customers).

Not only has LQ worked with a large portfolio of Finserv organizations (traditional and disruptive) for media buying and customer acquisition, but we also deeply understand the sales cycle. We put our own employees on the frontline calling prospects and we learn very quickly what motivates a Finserv customer to take action, qualifying and transferring over 250,000 leads / month.

Ready to learn more? Contact us today or download this white paper to learn about what it takes to become a Digital Economist.

LQ Digital taps Greg Allum as Vice President, Display & Social

By Katy Keim, CEO, LQ Digital

I’m pleased to announce we’ve kicked off 2019 with a bang by having Greg Allum join Team LQ as our VP of Display & Social! Greg comes to us from the UK and is a thought leader within his specific field of social media marketing who has consistently demonstrated the ability to build high performing social media teams, deliver innovation and grow revenue for the businesses he has worked in. He has risen from a skilled practitioner to being hired as European Head of Social for Sony and then onto Global Head of Social Media at Jellyfish, demonstrating his considerable reputation within the industry. More recently he has become a judge at the prestigious Drum Social Awards, which sets the industry standard for Social Media and has been running for over 20 years.

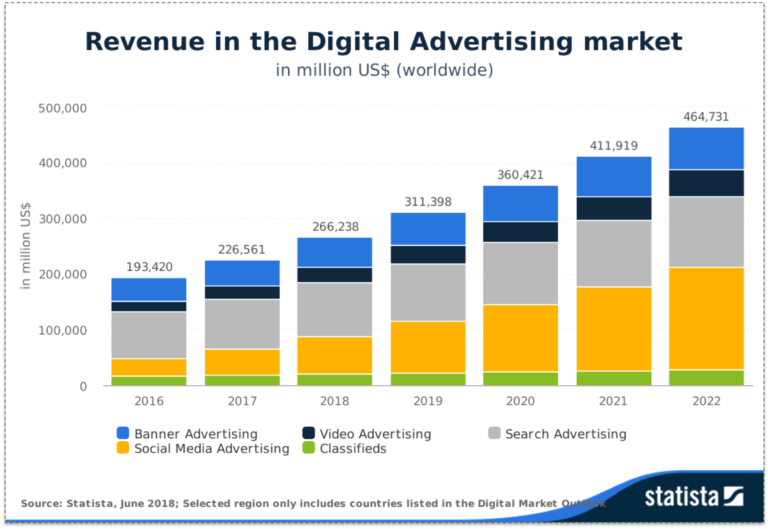

With social advertising revenue predicted to overtake search spend by 2020 (Source: Statista, June 2018) we believe growing a best-in-class practice focusing on ‘Brilliant Basics’ will enable further success for our clients.

“I’m excited to be joining LQ to drive growth for our business as well as for our innovative clients. LQ’s approach to viewing marketing through the lens of a Digital Economist rather than a Digital Marketer is bold, exciting and more importantly, delivers tangible and measurable results. Shifting the focus from ROAS to LTV allows companies to invest appropriately in identifying and acquiring highly profitable customers.” – Greg Allum, VP of Display & Social.

As we grow our practice, we’re also looking to hire paid social specialists and analysts in our Bay Area and Austin office. Take a look at our careers page if you’re interested! https://lqdigital.com/our-team/#join-our-team

Unit Economics: the Heart of Digital Customer Acquisition

Are you prepared to answer the 3 questions your CFO will likely ask you?

If you’ve been following along with our Digital Economist blog series, you will have learned a lot about the ins and outs of building a successful digital customer acquisition strategy for your business. Here’s a refresher of the basics.)

From building customer segments, made up of only your most profitable customers to developing persuasive value propositions to architecting segment-specific conversion journeys that drive action — it should be clear by now that digital customer acquisition isn’t something that just comes into fruition overnight. It requires testing, measuring, and constant refining. As market dynamics continue to ebb and flow, so will your digital customer acquisition strategy.

Remember, though, that at the end of the day, the entire purpose of digital customer acquisition is to grow your business. And while everything we’ve discussed thus far is important, how you — and your CFO— will ultimately measure success will come down to the revenue and profit generated by your digital customer acquisition program. In fact, a whopping 94 percent of CFOs have said they would increase digital marketing budgets if there were clear evidence it led to sales. This is proof that approaching digital marketing as a Digital Economist has its perks.

So, to wrap up this first wave of the Digital Economist blog series, we’re going to take a quick look at the important role that unit economics plays in assessing the overall economic impact your acquisition efforts can have on your business.

The goal of any digital customer acquisition program is to devise a plan that will pay off once you’re able to get only your most profitable customers into the top of the funnel. You might even ask yourself, “For every dollar I invest, what am I going to get out of that dollar invested?” Putting unit economics into action will help answer this question. It will uncover exactly what tactics you’ve deployed are working to generate the highest return on investment (across both channels and customer segments), what’s directly affecting CAC (customer acquisition cost), why LTV (lifetime value) might be greater for certain customer segments and channels than others, and, most importantly, how you will ultimately invest your next customer acquisition dollar. Measuring economic outcomes in this way will allow you to test all the work you’ve already done around customer segmentation, value propositions, and conversion journeys.

Here’s why this matters: your CFO will want to know that the budget you’ve allocated to digital customer acquisition is actually working. So, to help you shine in those conversations, let’s take a look at the three questions you’ll most likely be asked — and how you can come to the table prepared to tackle them with confidence.

1. When are you going to spend money?

If you’ve been through any budgeting cycle, you know that money doesn’t just appear out of thin air. The dollars you get for your digital customer acquisition efforts won’t either. For starters, your CFO will ultimately want to know exactly when you plan to spend the money allocated in order to determine when and where to make strategic trade-offs between different investments across the company.

This is where unit economics comes in handy. As marketers, we’re accustomed to reporting the success of our campaigns via vanity metrics like impressions and CTR. However, to help forecast budgets for the future, you’ll need to provide your CFO with line of sight into the sales and revenue pipeline, clearly articulating what value — and profit — can be achieved by continuing to dedicate budget to your digital customer acquisition efforts. Identifying both past and future success via CAC and LTV (which we’ll dive into more detail below) allows you to speak in terms your CFO understands. He or she will want to know — and have quantifiable proof — that your tactics are driving profitable growth. That’s really the key to locking in future budget.

2. Will you make more than you spend?

No CFO will ever expect the fruits of your labor to be in the black immediately. However, at some point, you will need to prove that your digital acquisition plan will eventually make you more money than you spend. To do this, your unit economics need to be buttoned up on two fronts: 1) spend per customer (CAC) and 2) revenue per customer (LTV).

For example, one of our clients is a health-conscious meal kit delivery subscription service. Over the last couple of years, this vertical has become increasingly popular — and with that popularity has come increased competition. This has driven up CAC considerably. To optimize for these highly competitive market dynamics, our strategy out the gate was to keep CAC low in order to learn the LTV of those customers. And based on the cost of a weekly subscription, we knew that newly acquired customers would need to subscribe for at several weeks to break even on that target CAC. Understanding this “break even” delta helped inform the client’s messaging and offer strategy and allowed us to identify, build, and execute campaigns that brought in customers most likely to subscribe for a longer period of time. This gave us the data we needed to fully understand their LTV.

While CAC calculations are great for understanding unit economics at the short-term individual customer level, oftentimes your CFO will also want you to paint a clear picture around what profitability could look like in the long-term. This is especially important knowing that a handful of customers will inevitably churn out over time. This is where calculating LTV comes in handy. Depending on the nature of your business, there are a couple primary ways to go about this:

- Perpetuity Model: This is best suited for businesses with a subscription model (as in the example noted above) where revenue per customer is more or less constant per month. The premise is that a certain percentage of customers will stay while another percentage will unfortunately leave. LTV in this instance is simply “monthly revenue” divided by “monthly churn.” Although this model can help estimate LTV on a forever-basis, it’s a great way to assess what LTV (cumulative revenue) for a set of customers could look like in shorter time frames (12-24 months) as well.

- Cohort Model: This is best suited for businesses where the amounts and timing of transactions are variable (think: e-tail). These businesses will typically use digital marketing tactics, like email, to promote discounts or other offers that incentivize customers to come back for more. The goal here is to understand, from among an average of all those new and repeat customers, what LTV might look like. However, as opposed to the purely future-looking perpetuity model, you need at least 8-12 months of customer purchase data to make an accurate prediction here. To run this calculation, group customers at the start of the any given day or month and then count cumulative transactions for that group of customers over time. Do this for multiple start times — and then layer that data on top of each other to create a curve that shows how, on average, revenue could grow and eventually plateau over time.

Another client of ours works in the insurance, loan, and mortgage business. At one point, we were asked to help them forecast the long-term value of all mortgage leads generated on a monthly basis. Why? Because mortgage leads take an average of 45 days before they actually become revenue for a bank. So, given this long lead-to-purchase lead time, our client wanted to know when they could feasibly expect to make a profit on their marketing efforts. The cohort model proved to be a good solution for addressing this question. By grouping all past customer acquisition efforts by month over the course of 12+ month period of time — and then identifying all future revenue attributed to it on a month-by-month basis — we were able to spot a clear trend that helped us predict, with confidence, how much our client should spend moving forward (per month) in order to achieve their specified growth goals, all without overloading their team.

3. When will you get make that money back?

Finally, in an effort to manage cash flow and, more importantly, temper investor expectations, your CFO will likely want to know when your digital customer acquisition efforts will finally turn a profit. This is where all the LTV measurements from above will become a true game changer.

With standard quarterly (or monthly) financial reporting, costs and revenues are reported purely on an accrual basis. The problem here is that by only looking at revenues vs. spend in-quarter, for example, you fail to paint the entire LTV picture. Within a given quarter, your CAC spend may have outpaced revenues, which can be extrapolated in this very narrow time frame as contributing to a loss in profits. Looking at the bigger picture, however, might tell you a different story: that cumulative revenue actually surpasses CAC spend over time. Therefore, you’ve successfully managed to turn a profit on your digital customer acquisition efforts (just not necessarily if you look at the numbers within the confines of a single quarter).

Here’s why this distinction is so important. By boiling your digital customer acquisition efforts down to unit economics around LTV, you can add value to traditional financial reporting that helps business leaders make a direct connection between performance marketing to future business growth and profitability in an entirely new light — and earning you a seat at the proverbial revenue table.

Are you ready to become a Digital Economist?

This now officially brings a close to the first wave of our Digital Economist blog series. Throughout the series, we’ve given you an in-depth look at the four key pillars of a successful digital customer acquisition program to help you understand the importance of approaching digital marketing through the lens of a Digital Economist. Now, it’s your turn to put everything you’ve learned into action. Are you up for the challenge?

To learn more, be sure to download our whitepaper, “The Rise of the Digital Economist.”

Creating Effective Conversion Journeys

Follow these steps to convert customers to action like never before

We’ve covered a lot of ground since beginning the Digital Economist blog series. Here’s a quick recap of what we’ve discussed thus far. In part one, we provided a bird’s eye view of the four key pillars of a strong digital customer acquisition strategy. In part two, we ran through the building blocks of customer segmentation — underscoring the importance of knowing exactly who your most profitable customers are. And in part three, we explained how creating value propositions tailored precisely to your customer segments can serve as your most powerful tools for persuasion. All of that helped set the stage for what we’re about to do now: creating conversion journeys that inspire your most profitable customers to take meaningful action — the kind that will grow your business over time.

Now that you know who your most profitable customers are and how you can motivate them to act, it’s time to architect a clear path that leads towards a purchase decision. This part of the process is important because as markets become increasingly saturated and competitive, digital acquisition costs ultimately rise. Optimizing how you convert your most profitable customers to take real and meaningful action is really the best way to keep costs down in the long-term.

Here’s the challenge: there’s almost an unlimited number of journeys a customer can take to arrive at a specific endpoint. There’s equally an unlimited number of ways they can slip up, get distracted, or even get lost along the way. It’s up to you to create the path of least resistance. However, doing that requires optimizing your conversion journeys with precision. This is by no means a one-size-fits-all exercise. You need to optimize conversion for each of your customer segments and then track and measure performance by segment and by channel to more clearly understand LTV (lifetime value) and CAC (customer acquisition cost) at an individual level.

Unfortunately, this is the hard part. Will you get it right on the first try? Maybe not. Good news for you, though, we’ve developed a three-step plan to help you get there. Let’s dive in.

Step 1: Question

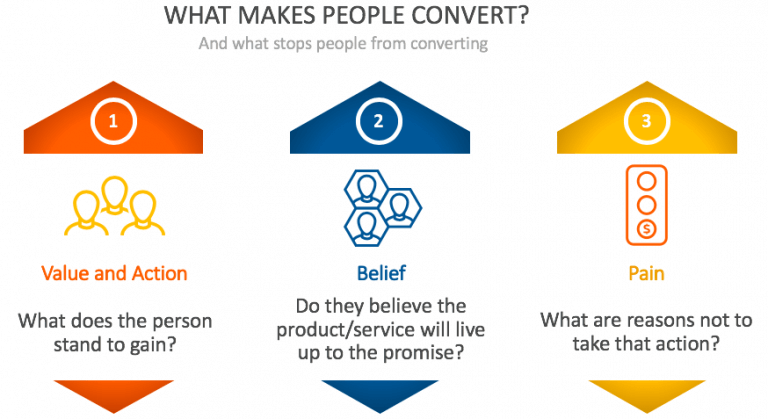

As a starting point, you need to come up with a way to spark initial action (aka, getting potential customers to convert). Part of this involves thinking about what could potentially act as roadblocks in that process as well. To do this, you need to build a case:

- Drive Value and Action: Start by helping customers understand what they stand to gain by purchasing your product and service. Identify the need at hand (“problem statement”), then show how the product or service being offered will specifically address that need (“value proposition”). Then, follow it up quickly with a clear action step that allows them to take advantage of the offer (“call-to-action”).

- Make People Believe: Just because you say your products and services can address a specific need doesn’t necessarily mean that alone will convince potential customers to act. You need to backup your promise with proof points —the same proof points you came up with when you created your value propositions. These are the bits of persuasion that will get customers to believe that what you’re saying is verifiably true.

- Minimize Pain: If you still haven’t gotten a customer across the finish line, here’s your opportunity to make a hard (and more emotional) sell. Make the upside of taking action abundantly clear. Depending on the product or service you offer, appeal to people’s sense of patience (or lack thereof) and need for instant gratification, unwillingness to change, or general aversion to risk. Do they think that it’ll take too long to see results? Is there a potential loss of time or money involved? Help assuage their fears and apprehensions head on, and you’ll give them one less reasons to avoid taking action.

Step 2: Hypothesize

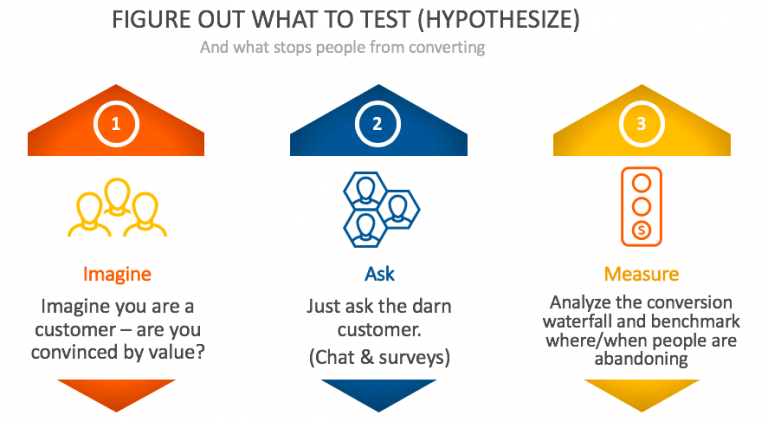

Now that you’ve crafted a bullet-proof sales pitch, you need to understand what exactly is stopping potential customers from taking action. As with all parts of the digital customer acquisition process, this involves a bit of trial and error. In other words, hypothesize and test your assumptions. Here are some easy ways to go about it:

- Put yourself in your customer’s shoes. If you were your target customer, would the pitch work on you? Is it convincing? You need to ask yourself both why and why not. This is a quick way to gut check. If your pitch doesn’t persuade you to act, what would make the situation different for a potential customer? (Hint: Nothing!)

- Ask for feedback. Why make assumptions — regardless of how educated those guesses are — when you can solicit feedback directly from customers? Customer support chat on your website are actually a great way to get indirect feedback. Customers will usually start up a chat because they have an issue or concern to deal with. If you pay close attention to what happens during those conversations, you’ll likely uncover specific pain points or confusion around value propositions. This just requires you to do a little digging after each customer conversation. Now, if you want direct feedback, it’s simple enough to send customers online surveys on specific points. This basically turns your customer base into a living, breathing focus group.

- Measure what’s actually happening. The great thing about this digital world we live in is that we can essentially track every action along a customer’s journey in near granular detail. Make sure your web analytics tools are set up so that you can see and track where people are engaging the most and dropping off along the journey you’ve created. While you’re at it, be sure to take a close look at what you’re asking customers to do at each step of the way and what conversion is happening. This can shed light into what customers need to believe in order to take action at each of those steps. You’ve got the data, so make good use of it.

Step 3: Test and Learn

We wouldn’t be proper Digital Economists if we didn’t continuously test and measures our assumptions to refine our digital customer acquisition efforts at every step of the way. Building conversion journeys is no exception to this rule. So, based on the hypotheses you reach above — regardless of how you get there – you need to create, test, measure, and learn from a real-life digital scenarios. The easiest way to do this is by mocking up a user experience (UX) flow, identifying the points where it’s essential to communicate a clear value proposition and adding in the right call-to-action steps or qualifying opt-ins. Once you’ve laid out the flow, convert it to a branded user interface (UI) that you can code into a landing page. Then use your web analytics tools to help you measure the effectiveness of those test flows. And then start all over again with new hypotheses. The more you test, the more you’ll know. And the more you know about what works and what doesn’t, the more effective your conversion journeys will be.

What are you waiting for?

As you can see, creating effective conversion journeys requires a bit of trial and error. You won’t necessarily get it right the first time, but with patience and the right amount of testing and measuring, you will be able to turn your digital marketing efforts into a conversion machine.

Want to learn more about how we help clients with their conversion journeys? Check out the NewHomeGuide.com case study and read more about how we helped them achieve 124% conversion rate improvement YoY.

The Ultimate Weapon of Persuasion

Your value proposition is your ticket to creating a connection with potential customers

In part one of our Digital Economist blog series, we laid out a four-step game plan for building and executing on digital customer acquisition strategies that ultimately drive revenue and profitability. Now, it’s time to move onto the second step of the process and learn about the ins and outs of creating a value proposition that persuades people to buy from your business.

Creating a strong value proposition is just as much about telling a story as it is about making a convincing argument. As a starting point, you have to equip people with all the reasons why your products and services are better than the competition’s. But then you need to go one step further by creating a sense of urgency that incentivizes people to buy what you offer in real-time while equally giving them a good reason to be loyal to your brand for the long-term.

We recently discussed the building blocks of customer segmentation. The big takeaway there was that you must intimately know who your most profitable customers are in order to target, reach, engage, and eventually convert them into actual (and paying) customers. A byproduct of knowing, testing, and constantly redefining who your most profitable customers are is being able to articulate a clear and concise message that will resonate with each customer segment to maximize conversion. This is where building a persuasive value proposition comes into play.

You might be thinking to yourself that this is a bit of a no-brainer. The truth is, it should be; however, more often than you might expect, brands will pepper potential customers with a litany of facts and figures, only to fail at creating a real and meaningful connection with them. So, let’s get back to basics and review the core components of a great value proposition, so you can avoid falling into this trap:

- Core Values: You may know what your brand stands for better than anyone else. But how well do you know what your target customers value most? In the game of digital customer acquisition, you have to put yourself in your customers’ shoes. What do they care about? What do they need (from your brand)? What motivates their daily habits – and beyond? Creating a value proposition that resonates with your target customers means speaking in their language — and showing them that they are your top priority. By tapping into the core values of your most profitable customers, you can carve out a message — through your value proposition and other associated communications — that is both unique to your brand and to your customers wants, needs, and expectations, providing more of an emotional “hook” for them to latch onto. This is why you must pinpoint your customer segments first. Without knowing who your most profitable customers are, how can you tap into their core values? (Hint: you can’t!)

- Differentiation: Every brand wants to stand out from the competition. By rooting your value proposition in your customers’ core values, you automatically achieve this. However, there’s always room to go one step further. Think about who your nearest competitors are. This can include: direct competitors (businesses with the same offering and business model), indirect competitors (businesses with a similar offering and core values but a different business model), and disruptive competitors (businesses with a similar offering but unique core values that solves a customer problem in an entirely new way). Think about how they all communicate externally, closely examining what they do well — and also where they fall short (as that could be an opportunity for your brand). Then take a step back and think about your brand from their perspective. What do you do well? What do you do differently? Understanding what makes your brand unique – in the context of your competition – is an added layer that can bring your core values to life in a way that only your brand can truly own.

- Proof Points: These are what persuade potential customers to believe in your core values and clearly see how your brand stacks up to the competition. These can come in the form of stats, product features, customer reviews and testimonials, and other claims that aim to push customers more quickly down the funnel, from consideration to purchase. The reality is, as wonderful of a story as the combination of your core values and your points of differentiation are, no one is going to believe what you say without a little proof to back it up.

As you go through this process, there are a few things to keep in mind. First, you have to stay laser-focused on who your most profitable customers are and what they care about. This will make it easier to create value propositions that directly address their wants, needs, and expectations — especially in the time and place where they see your marketing message. That’s why you can’t simply create a value proposition in a vacuum; you must tailor your value propositions — yes, plural — to each of your customer segments. Being thoughtful about how you map your messages to specific customer segments will ultimately increase your chances of getting potential customers to a take a desired action. And second, it’s important to remember that creating a value proposition isn’t a “one and done” process. Customer needs will change. Your competitor will launch a new offer. The possibilities for change are endless. That’s why you must constantly revisit your value propositions to make sure they still hold up to ever-changing market dynamics.

Depending on the purchase decision being made or the product or service being offered, brands can choose to pull a couple different levers of decision-making: rational or emotional. Developing a value proposition is a highly rational exercise; after all, your focus here is to create messages and proof points based in rational facts about why your products and services are the best fit for your target customers.

But simply spouting out a long list of facts isn’t all that persuasive. And that’s because, in spite of how rational we all like to think we are, humans by their very nature oftentimes make decisions based on emotional factors as well. In fact, persuasion itself is about creating a connection — or in this case, a reason to believe. So, knowing that creating your value proposition is equally an exercise in communicating rational factors in a persuasive way, your goal must be, above everything else, to tell a story around those facts, creating an emotional connection with your customers that helps them see and feel why your products and services will benefit their lives in more ways than the competition can.

The Principles of Persuasion

Perfect segue! It should be clear by now that creating a value proposition is really all about persuasion at its very core. The story that builds around that value proposition has the power to not only create a meaningful connection between your brand and potential customers but also can inspire more immediate action and long-term loyalty. You may have heard about the six principles of persuasion. These are the motivators that have been shown time and time again to drive action. Here’s a quick overview through the lens of digital customer acquisition:

- Reciprocity: You incentivize customers to take a specific action by promising to give them something in return — whether a promotional discount, a two-for-one offer, or something that makes them feel as though they’re getting a good deal. It’s basically an upfront way of thanking prospects for taking a chance on your business.

- Scarcity: This comes down to supply and demand. The less of something you have to offer — i.e. the potential for a product to sell out or a promotional offer to expire — gives you the opportunity to persuade with a message of urgency. It’s basically the notion of “first come, first served.” (And it works because people love a good deal!)

- Authority: You can talk about how great your products and services are until you turn blue in the face. However, that’ll only get you so far. By inviting outside sources who are considered (or can be viewed as) experts in your industry to give your brand a thumbs up, you’re able to build more (perceived) credibility around your message.

- Consistency: Past behaviors can help predict future behaviors. For example, you may launch an email campaign around a new promotion to re-inspire engagement among your customer database. Based on how those customers responded to past email campaigns with similar offers, you can almost guarantee similar or greater results this time around — because once you’ve been successful at driving a specific behavior, it becomes much easier to drive that same behavior once again.

- Liking: This is about creating that personal connection with potential customers. People, generally speaking, tend to gravitate towards brands that speak like them, that act like them, and that resonates with them. When you build a value proposition through the lens of your customer segments, you can achieve this.

- Consensus: People are easily persuaded by others, especially in large numbers. In other words, the concept of “when it doubt, follow the pack” rings true for many when making big purchase decisions. After all, if the vast majority of people surveyed love a specific product or service, why wouldn’t you as well? This can be a great way to give your message the added support it needs to push customers across the finish line.

So, why mention any of this at all? Because creating a strong value proposition — one that’s unique to your brand and relevant to your most profitable customers — is an exercise in persuasion. As Digital Economists, LQ helps you bring your value proposition to life through digital advertising campaigns that apply the six principles of persuasion. We also refine and test those value propositions regularly to see what drives the highest conversion of your most profitable customer segments over time. Marrying the two is your recipe for success.