High-tech + Low-tech Growth Challenges for Mortgage Lenders

The mortgage industry has faced a number of challenges in recent years: technological advancements, increasing competition and lack of entry-level housing. All of which have added mounting pressure to mortgage lenders looking for growth and profitability. However, most lenders have also relied on low interest rates & the refinance boom to fuel their loan growth the last year or two. With new, well-financed lenders disrupting the market and the threats of higher mortgage rates and tighter lending standards in 2020 and 2021, leading lenders are starting to prepare for greater competition.

So how are lenders responding?

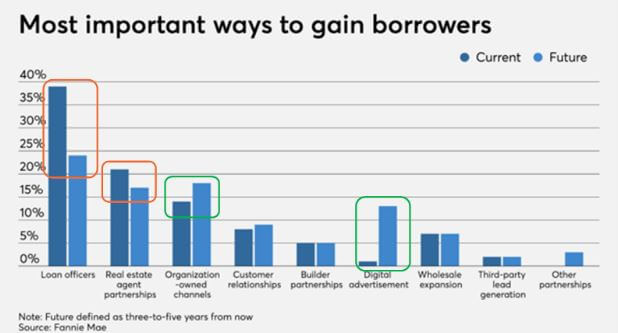

A recent article by National Mortgage News reviewing Fannie Mae’s Dec 2019 Mortgage Lender Sentiment Survey reports a majority of lenders are planning to fuel their growth over the next 3-5 years by diversifying where they source new loan leads. They will be adding to their traditional model of relying primarily on LO networks and RE partnerships, by dramatically increasing their investments to generate leads from digital channels (owned and paid). The goal is to help them generate more leads, particularly from the younger generation who favors mobile and digital engagement.

Interestingly, at the same time, additional articles from National Mortgage News have called out that despite this shift to more digital mortgages, Personalization still matters. Although more future customers will be researching more online, and looking for more efficient online options to streamline much of the borrowing process, it does not mean their journey ends behind a screen. When borrowing hundreds of thousands of dollars on a home loan, it turns out most people (even millennials) state that they prefer at some point to talk to a human being.

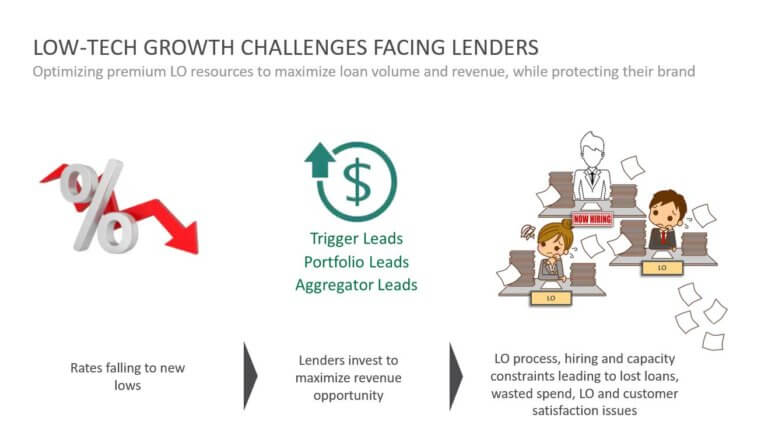

However, in the very low rate environment we have experienced for the last year, many lenders we work with are “jumping in” with increased budgets to take advantage of this great lending opportunity. The biggest operational hurdle many face is keeping enough loan officer capacity on line, and operating at optimal efficiency, to keep up with demand. Added hiring increases labor costs that eat away at margins, while hiring delays stall growth and reduce revenue. Finding ways to maximize the amount of existing loan officer capacity focused on closing loans (vs being distracted with qualifying or nurturing lower-quality leads), while increasing their efficiency at closing, is the virtuous cycle that generates maximum growth in closed loans units, revenue and profits.

However, in the very low rate environment we have experienced for the last year, many lenders we work with are “jumping in” with increased budgets to take advantage of this great lending opportunity. The biggest operational hurdle many face is keeping enough loan officer capacity on line, and operating at optimal efficiency, to keep up with demand. Added hiring increases labor costs that eat away at margins, while hiring delays stall growth and reduce revenue. Finding ways to maximize the amount of existing loan officer capacity focused on closing loans (vs being distracted with qualifying or nurturing lower-quality leads), while increasing their efficiency at closing, is the virtuous cycle that generates maximum growth in closed loans units, revenue and profits.

This blog reviews the best practices we have identified over 15 years to drive loan volume and revenue growth for both large traditional lenders and disruptive digital startups (across mortgages, HELOC, equity loans, educational and personal). These fall into two basic categories.

- High-tech (Digital Growth) strategies

- Low-tech (LO Efficiency) strategies

Strategy 1: Building a Successful, Modern Digital Growth Strategy

The digital native generation – millennials – are finally coming to market after years of postponing home ownership. So if you want to be profitable in the years to come there are 3 key principals we guide our marketing executive clients to think about and solve.

1. Separating KPIs from Economics

Too many marketers focus on upper-funnel vanity metrics (e.g. impressions, clicks, CTR, CVR) instead of translating and speaking at all times about their activity in terms of its bottom-line impact on growth metrics that drive their business (e.g. how many units were sold, at what unit value, at what CPFL or LTV/CAC). Only by refocusing on business growth metrics can a marketer judge and measure the true value of different growth strategies.

2. Full Funnel Visibility

Many lender marketers say they have this, but yet they cannot answer what is their current CPFL. This is because getting this data is hard. It is captured in multiple systems across both sales and marketing, which means it is typically not available to marketing (or if it is, it is not generated daily, but at most monthly) due to the complexity in pulling it together. The lack of having real-time data on the cost per unit sold (CPFL) prevents marketers from having the insights needed to guide media decisions to drive real bottom-line growth. Marketers are too often blind to the true economic impact of their decisions on the business, limiting their ability to delivery true growth.

3. Segments Before Channels

Once you have access to a real-time, full-funnel view into your marketing performance, you can use that data to then answer what are your highest-value target customer segments to prioritize (e.g. which generate higher LTV/CAC). By knowing what each segment is worth, and what they cost you, by channel, only then will you be armed to build the optimal media plan (across each channel) to maximize your total business growth at the lowest blended cost.

Our Feb 2020 webinar with Blend talks in more detail about how leading mortgage lenders can use these lessons to modernize their digital customer acquisition strategy to generate loan growth in 2020 and beyond (view the webinar here).

Strategy 2: Leveraging a Contact Center To Maximize LO Closed Sales

Over the last 15 years, our Contact Center Services have partnered in growth campaigns with clients operating in several complex, considered-purchase product environments (e.g. lending, real estate, education, B2B technology and B2C subscription services). In each we proved how strategically leveraging call center resources:

- Satisfied the personalization needs of the potential borrower.

- Created a positive customer experience that strengthened their relationship with the lender’s brand.

- Improved conversion rates by proactively engaging potential borrowers (e.g. loan app not completed) in a live discussion to accelerate their movement down the sales process.

- Qualified out leads that would not qualify for a loan or were not serious about applying today, before having them speak with a loan officer.

By strategically leveraging a call center team to offload some of this early-stage work otherwise left to LOs, the number of leads that can move through the sales process increases dramatically. This results in increasing closed loan volumes by maximizing the LO time spent closing qualified loan applicants – while simultaneously reducing the new LO hiring requirements to reach those higher closed-loan numbers.

Our whitepaper “The Power of the Call: Your Secret Weapon to Maximize Revenue and Reduce Costs” describes the specific methods for leveraging a Contact Center to help you maximize the loan-closing impact of your existing LO resources, improve conversion rates and reduce cost-per-lead (download the whitepaper here).

Customer Acquisition for FinTech – The David and Goliath Story

Make sure you bring the right sling

By Patrick Wang, Chief Digital Economist, LQ Digital

It seems like every day you hear of a new Fintech startup entering the market with a better mousetrap. New technologies from Google and Facebook have allowed disruptors to reach customers directly, blockchain has created new ways to underwrite contracts, and emerging mobile and data techniques are changing the way companies can deliver financial services quickly and at lower cost to the consumer. Like the David, their ability to strike where it matters have allowed them to exploit chinks in the armor of large traditional financial services companies.

Despite the interest and hubris of all Fintech disruptors however, Fintech companies would be wise to respect that Finserv incumbents are still Goliath’s in the space and for good reason. Challenging them in the wrong way will lead to certain defeat as they can be crushed by their sheer mass and resources. Banks and other financial institutions have spent the better part of a century consolidating and monetizing the value of each customer they capture. They can afford to take a loss on an initial transaction so that they can ultimately cross-sell customers into other services.

Take for example: JP Morgan Chase. After 100+ years rolling up Finserv offerings – they can afford to acquire checking and savings customers at a loss – by creating an engagement vehicle to market a full line of financial services from mortgages, home equity, unsecured loans etc, and vice versa for other product lines.

In contrast, a Fintech disruptor like LendingClub started out tackling personal loans with a best of breed solution – offering quicker funding, better rates, and ease of service based on novel capital sources and new lending risk models. An attractive value proposition on its own, but is it enough to build a competitive business in a room filled with giants?

What’s the Problem?

The challenge for all Fintech disruptors trying to grow profitably is this:

They must be surgically precise about the profile of financial customers they are looking to acquire because:

- Large incumbent banks have had the luxury of being less precise with their customer acquisition strategy because they offer a full line of services (they can bring everyone in and offer something of value)

- Copying a large bank’s broad go-to-market will lead to Fintech disruptors depleting their limited growth budgets, while quickly finding out that they can’t service many of those customers profitably.

Making a hard problem harder is U.S. financial marketing compliance.

- U.S. Fair Lending regulations restrict targeting consumers by many of the dimensions that can signal customer value to a Fintech disruptor. With this constraint, many Fintech companies are quickly forced down a path where they find themselves in a crowded acquisition market with not one, but two or three large incumbents with little room to maneuver.

Fintech disruptors have much less room for error when it comes to acquiring customers.

- Large banks have large balance sheet and an already established portfolio of customers to lean on, so they are insulated from customer acquisition investments gone bad. A fintech disruptor has less margin for error as a bad bet can submarine their growth.

The margin for error continues to erode.

- Cost per clicks (CPC) continue to rise year over year as the competition for growth continues to increase with both traditional finserv and fintech companies going after the same fixed pools of interest.

Bringing a Sling to the Customer Acquisition Melee

What does success require a Fintech disruptor to stand a chance and not get crushed by exorbitant CPC’s, locked up lead marketplaces, and loss-making acquisition?

- Having a clear sense of the specific customer profile where they have an unfair advantage of converting customers.

- Knowledge of both new and old pathways to financial customers and who the customer brokers are in those spaces. Knowledge of these go-to-market channels allows Fintech companies to comply with regulation and at the same time target and segment their customer acquisition.

- A detailed and precise instrumentation of their sales cycle tied to the marketing channels that drive acquisition so that they have confidence in the acquisition investments they are making in advance of revenue.

Why Partner and Why Now?

- Diversity of Skills – Few individuals and organizations have the diversity of skills needed to be a successful all-in-one team (e.g. data science, media buying, conversion design and tech, messaging, etc.). It’s a multi-disciplined approach that requires skills from scrappy startups and knowledge of the “old world”.

- Data Capture / Benchmarking – Success requires capturing as much data as quickly as possible and then comparing those to 3rd-party benchmarks on channel performance. With access to this data, Fintech disruptors can quickly assess – is it our offering? Or is it the customer? Having a partner that’s worked with many other Finserv companies allows you a unique perspective on “what’s to be expected in the space”.

- Measuring Segment Unit Economics (performance from marketing KPIs down to LTV) – Calculating the potential likely future revenue / profit from each lead source or type is critical to helping you direct today’s media spend towards the channels and conversion strategies that will deliver the most revenue and profit, at the lowest marketing cost. Expertise in knowing how to implement accurate data tracking from marketing platforms to your CRM, and then analyzing that data, can be a difficult to find internally in fast-growing startups.

- Time to Market – Once a fintech disruptor’s offering is in market, the clock is ticking. Competitors have a chance to observe and replicate many of the valuable aspects of their offer. Having established relationships with publishers and lead brokers allow companies to accelerate their growth and not stumble over many of the common pitfalls in the industry.

Why LQ?

In short – we have all of the ingredients for Finserv acquisition success.

- For LendingClub we managed media against a cost per issued loan. (So we built data precision on how media turns into revenue, and built markers earlier/higher up in the funnel that signaled which leads were more likely to turn into revenue).

- For one of the largest multi-national financial services institutions, we helped them optimize their Direct to Consumer mortgage channel, accelerating their time-to-market by 1) short-listing the lead partners to work with, 2) rapidly stand up those relationships, and 3) optimizing each relationship against a cost per funded loan performance metric leveraging performance data captured through a lead conversion process we managed.

- For SmartBizLoans, we are able to target the specific profile of small business owners who can both credit and revenue qualify for their loans. (So we know precisely how to target serviceable customers).

Not only has LQ worked with a large portfolio of Finserv organizations (traditional and disruptive) for media buying and customer acquisition, but we also deeply understand the sales cycle. We put our own employees on the frontline calling prospects and we learn very quickly what motivates a Finserv customer to take action, qualifying and transferring over 250,000 leads / month.

Ready to learn more? Contact us today or download this white paper to learn about what it takes to become a Digital Economist.

Don’t Forget About Conversion Rate Optimization

Why the most overlooked part of digital marketing is actually your most powerful tool

You’ve built a brand. You’ve taken the time to develop your website and digital presence. You’ve crafted an SEO strategy. You’ve identified your target audience – aka, your most profitable customers. You’ve created a unique message to resonate specifically with that audience and haven’t wasted a single minute getting that message out there via digital advertising. Right now, you’re probably thinking that you’ve got everything moving full steam ahead – and, in many ways, getting this far puts you way ahead of the curve. But there’s one part of this digital marketing equation that you’ve probably overlooked: conversion rate optimization.

Defined as the art and science of getting people to act once they arrive on your website, conversion rate optimization is, more or less, the operational side of digital marketing. It’s not as “sexy” as all that outbound, creative work you’ve been doing to build the side of your brand that your customers see. However, what you may not realize is that conversion rate optimization can actually make a huge impact on how you grow. It provides insights into which of your marketing tactics – on your website and via digital advertising – are driving your business goals forward versus those that are underperforming. So, in essence, conversion rate optimization can make all of your marketing efforts a lot more effective.

Why then, in spite of all the clearly defined benefits of conversion rate optimization, does it tend to be the forgotten part of digital marketing? One of the biggest reasons is because it’s hard work. For all intents and purposes, it’s purely scientific. You create a hypothesis. You test that hypothesis against a control. You measure the effectiveness of both variables over a period of time. You draw conclusions from that test and then implement changes on your website or in your digital advertising efforts based on what proved to be most effective. And then, you start that process all over again with a new hypothesis.

This essentially means that the work of conversion rate optimization is never really “done.” Sorry, you don’t get instant gratification. It requires time and patience. The very ongoing nature of conversion rate optimization can feel daunting because there is a never ending number of factors to test – and in various orders – to see how your can maximize the effectiveness of your digital presence. And while each test is an opportunity to learn something new, sometimes the end result doesn’t even support your initial hypothesis. But you have to embrace this ongoing test-measure-repeat cadence to see how even small changes can drive serious performance gains (i.e. doubling conversion rates). With conversion rate optimization, you have to trust the data because data doesn’t lie – even if your creative sensibilities hoped for a different outcome.

Another reason why conversion rate optimization doesn’t always see the light of day in many organizations is due to a lack of alignment between the marketing and tech teams. Simply put, marketing must convince the tech folks – who typically have the final decision – to buy into it and actually agree to allocate resources to support it. The challenge is that the tech team has its own priorities, which likely have nothing to do with increasing conversion rates. When it comes to your brand’s website, what only matters to them is whether it’s working or not. “If it’s not broke, then don’t fix it” is typically the mentality of a task-focused tech team. All those little, never-ending, and time-consuming iterations that you need them to deploy and manage can be easily perceived as a massive headache in the making. So, it’s no surprise that convincing them on this front can feel like an uphill battle.

But, as a marketer, conversion matters to you because you know that being able to convert more leads into actual customers is the best way to deliver long-term business value through marketing. It’s also the most measurable way to demonstrate the success of your marketing efforts. After all, conversion rate optimization can make all those results stronger. But you can’t do it all on your own. You need strategists to come up with a non-stop supply of hypotheses, design support for all those iterations you’re testing, the ability to deploy and test new variables quickly, as well as the data to help you see what’s working. So, when you can’t get the support internally, it’s a massive roadblock to results.

We know this at LQ. That’s why we’ve taken an entirely different approach to conversion rate optimization. We know just how important it is for brands to do this kind of work. So, to help ease the pain, we oftentimes offer our expert services on a pay-for-performance basis. Not only is this a huge incentive for us to help brands drive real performance gains – which is what we love to do most – but it’s one way we can demonstrate how we “talk the talk and walk the walk.” This is one of the biggest reasons why Microsoft Bing named us “Optimizer of the Year.” We challenge ourselves every day to take new approaches to conversion rate optimization to help our customers create a better and more compelling brand story. It may seem like the “blue collar” work of digital marketing, but it’s not really; it’s just as important – if not more – than all of your other marketing tactics. We know the large rewards that stem from it. If you want to learn more about what it entails, we’d be happy to help.

Long story short: if you think you’re doing everything possible to reach, target, and engage prospects and eventually turn them into loyal customers, there’s a good chance you’ve missed the most critical part of the digital marketing equation: conversion rate optimization. Sure, it’s not the sexiest, but it delivers real, measurable results and makes all that sexy and fun creative work you do more effective in the long run. After all, why invest in your digital presence if you aren’t willing to take the time to make it as strong and effective as it can possibly be?

The Rise of the Digital Economist

Why being a “creative genius” is no longer enough in today’s digital world

Once upon a time in the era of traditional marketing, devising strategies for developing memorable brand creative across TV, print, and other media was a marketer’s primary responsibility. There were some performance-driven direct response variations on this theme as well, but the brand creative itself was the genius “big idea” for all campaign communications.

Then, digital became king almost overnight, giving marketers reason to panic. They were now faced with a creative dilemma: how to strike the careful balance between telling a compelling brand story and earning quantifiable clicks. And as measuring marketing performance quickly became the new norm – where new metrics were emerging each day across different platforms, devices, and media types – everyone from the CMO down started thinking like a “performance marketer.” Data suddenly became the new creative brief, signaling a seismic shift from “Don Draper” thinking to a newfound focus on hyper-targeting, deep segmentation, real-time optimization, and personalization. Campaign strategy was no longer about the proverbial “silver bullet.” The focus shifted to intimately knowing, finding, and delivering on consumer needs.

Fast forward to the present day. Digital marketing in the U.S. alone is poised to reach $120 billion by 2021, accounting for 46 percent of all projected advertising spend. This represents a combined 11 percent y/y growth from 2016 to 2021 across paid search, display and social media advertising, online video, and email marketing – and that pace doesn’t seem to be slowing down anytime soon. Why? Because digital is a solid marketing investment. Compared to other media, digital can be measured with absolute precision to help marketers spend smarter and more efficiently.

At LQ, we’ve learned that succeeding in today’s digital-first world means thinking and acting a lot less like marketers and, oddly enough, more like economists. Digital economists, that is. To help explain what I mean by this, it’s worth revisiting our Economics 101 days to understand how we can approach customer acquisition through the lens of:

- Unit Economics

- Supply + Demand

- Marginal Cost < Marginal Revenue

Unit Economics

Unit economics is defined as the direct revenues and costs associated with a particular business model, expressed on a “per unit” basis. In other words, it’s about breaking down the revenue and costs related to a particular customer to understand what ultimately drives profitability.

Let’s use a lemonade stand to illustrate this concept. Say you charge $1 per glass of lemonade. Now, let’s breakdown what goes into that $1. The lemonade costs you 6 cents to make; your location, table, and umbrella amount to about 9 cents; your labor is 25 cents (we are in California, after all!); and your marketing – flyers in the park and other signage – is only 2 cents. Your unit economics for that glass of lemonade are roughly:

- Revenue: $1

- Expenses: $0.42

- Profit: $0.58

Based on this breakdown of costs, unit economics says that I am able to generate 58 cents of profit for every customer who purchases a glass of lemonade from me for $1.

Instead of focusing on profits, a digital marketer might measure success purely based on quantifiable campaign metrics: total spend, number of leads generated, cost per lead, cost to close a sale. A digital economist, on the other hand, prefers to approach success by asking bigger picture question: “How can I increase my profits by adding more units?”

When we speak to our clients about profitable growth, we start by asking a few important questions. How do you make your money? What’s the average cost to acquire a new customer? How long do customers stick around? How much do you earn from them (LTV)? Then, we dig a little deeper to understand how the answers to those questions vary by product, geography, demographics, and so on. The end goal here is to understand what levers we can pull to move a business forward in a profitable way. This informs how we approach a unique customer acquisition strategy for each of our clients. Unit economics essentially guides our way.

Supply + Demand

Supply and demand is formally defined as the amount of goods and services available for people to buy (supply) compared to the amount of goods and services people want to buy (demand). In its simplest form, it speaks to market dynamics and competition. Either way, this principle is at the heart of digital acquisition.

The world of digital marketing is an auction-based environment. Before kicking off any campaign, you need to ask yourself how much you are willing to pay to acquire a customer, considering what the market clearing price is.

Let’s look at another example. Say you’ve identified two specific customer segments that you’d like to target in your next campaign. Both are worth $50 to your business. Time to start bidding. You quickly learn that it costs $25 to acquire “Customer A” and $75 to acquire “Customer B.”

The difference in cost to acquire these different customer segments may tell us something unique about the market: 1) that the total supply of “Customer B” is potentially less than “Customer A,” and that they are harder to find; 2) that competitors are willing to pay more to reach and engage “Customer B,” which makes it even harder for you to break through the noise; or 3) that you may be able to extract more value from “Customer A” because there are either more of them available to you in your target market or their attention is not being commandeered as much by other competitors (or both!).

If we approached this scenario in averages, as many marketers tend to do, if half of our new customers were from the “Customer A” segment and the other half were from the “Customer B” segment, then you could say that we acquired them for an average cost of $50 per new customer. And since a new customer is worth $50 to us, we therefore broke even.

Unfortunately, that’s not how economists think, nor is it how we would actually behave in an auction. The truth is, we would bid aggressively on “Customer A” – and we would bid to win – bidding up to $30, $40, or even $45 at most to acquire each new “Customer A” to ensure we still make money from each new customer acquired. In that same train of thought, we’d be forced to abandon any hopes of acquiring “Customer B” because we’d lose money the moment we entered that auction for any price above $50.

Long story short: you need to not only know who your target customer is, but also understand the market clearing price to win their attention, always proceeding with profitability in mind.

Marginal Cost < Marginal Revenue

To put it simply, marginal cost is the additional cost incurred for the production of a single unit of a product or service. Relatedly, marginal revenue is the gross revenue earned from selling one additional unit of a product or service.

Economics tells us we should continue to increase volume as long as marginal revenue exceeds marginal cost. The crudest example of this is a single seat on an airplane. The plane, the fuel, the flight crew, and all other fixed costs will be spent to operate the flight, whether or not we add one more passenger. The only marginal cost that might come with filling another seat at the gate could be the cost associated with providing an additional free in-flight beverage. So technically, airlines should never really charge more than $1 (or some minimal amount) to add one more passenger at the gate because the marginal revenue will always exceed the marginal cost vis-à-vis the fixed costs already incurred. Any additional revenue is just gravy. If you travel often, you know that airlines do not behave this way.

Marketers overlook this all too often when talking about adding volume on digital channels. Why? Because they have a tendency to think in terms of overall costs and short-term metrics, such as return on ad spend (ROAS). Here’s a great example. A current client of ours was getting 70 percent of the volume at around $0.50 per click. To outbid competitors, they would have to get the last 30 percent at $1.50 per click. We advised them to take on more volume, which cost about $20,000 more, but their response was: “That’s way too expensive!”

Well, not really. Their marginal revenue still exceeded the marginal cost of taking on that extra volume. Campaign 1 cost them $10,000 and generated $50,000 in revenue (5:1 ROAS) while Campaign 2 cost them another $30,000 and generated $90,000 in revenue (3:1 ROAS).

| Phase | Ad Spend | Revenue | ROAS |

|---|---|---|---|

| Campaign 1 | $10,000 | $50,000 | 5:1 |

| Campaign 2 | $30,000 | $90,000 | 3:1 |

| DIFFERENCE | +$20,000 | +$40,000 | 2:1 |

They thought we were looking at the metrics in the wrong way; from their point of view, the new spend was inefficient. In an economic view, however, they are still achieving profitable growth by spending a marginal cost of $20K more to earn a marginal revenue of $40K. Honestly, a company should bet on those odds any day.

It’s Time to Think Like Digital Economists

Like economics, digital marketing is a numbers game – and those numbers don’t lie. But the difference with digital economist thinking is that it gets you to measure success in terms of lifetime value, not volume. Also, it ensures that you remain fanatically focused at all times on targeting, reaching, engaging, and converting only the most profitable customers for your business. If you take a step back and think about it, this mindset shift will not only help boost your bottom line – and help you achieve your business objectives better than ever before – but it will also improve the overall effectiveness and efficiency of your marketing efforts. It’s honestly a win-win – that is, as long as you allow yourself the freedom to get out of your digital marketing comfort zone.

In Search of the Elusive “Profitable Customer”

Marketers should stop counting leads and shift their focus to Lifetime Value (LTV)

Not all customers are created equally.

Some stumble upon your brand, drop in to test out your product or service, and maybe make a small purchase – only to never come back. Others are instantly enamored by your offer, build a connection with your brand, and quickly turn into customers for life. It’s hard to say which path a new visitor to your business will take if you’re simply casting a wide net with your marketing efforts. Hoping that a few of your new “leads” stick around leaves a lot to fate and can quickly drain whatever marketing budget you have.

All too often I hear marketers throw around “leads generated” as a success metric worth bragging about. While it might be a good indicator of the overall impact of a marketing campaign, it fails to deliver on your real business objective: driving profitable growth by increasing your long-term customer base.

Besides, a lead is not an actual customer. It’s merely the potential for someone to become a customer. At that point, the ball is in your court to make that lead believe in your business. That takes time, money, and valuable resources before that conversion ever happens – and when it does happen, there’s still no guarantee this new customer will continue coming back for more.

Consider Blue Apron’s lackluster story of going public. At the time of the IPO, the company claimed one million customers, but was still far from profitable. Why? Because many of those customers were still in the “trial” phase of their relationship with the brand. They were willing to give the meal kit service a shot, but not necessarily ready to commit to an ongoing subscription. Unfortunately, this assumption proved to be true, with the company now facing a surprisingly high estimated churn rate of 72 percent within six months. Add to that the cost of acquiring a new customer over the last twelve months, estimated at a whopping $460 per customer, and it’s becoming a challenge for the company to break even. This is a perfect example of leads not delivering long-term value. Blue Apron saturated the market with offers and promotions – from digital to direct mail – but that’s about as far as they got.

When this happens, you have to ask yourself, “Was this worth the cost?” The easy way to answer this question comes down to a relatively simple calculation of Lifetime Value (LTV)/Customer Acquisition Cost (CAC). If you aren’t at least breaking even, it’s time to rethink your overall customer acquisition strategy. To put this in context, the most sophisticated businesses regularly achieve customer lifetime value at three to five times the cost of acquiring a customer. This is where you want to be. It’s not sustainable to consistently have the scales tipped in the opposite direction.

Marketers have got to be smarter, savvier, and much more efficient when it comes to customer acquisition. They need to think like economists and operators, not like campaign managers and traditional marketers. They need to shift their focus from “generating leads” to “finding the right customers.” This means building a strategy that ultimately delivers long-term profitable growth.

As one client recently said to me: “I’m moving from a cost center to the revenue team.” That’s the spirit! Your business objective is to be profitable. As such, your marketing team needs to deliver more than just new customers; it needs to deliver great ones. Unfortunately, it’s hard to achieve that goal if you don’t stay laser-focused on earning the loyalty of “profitable customers.” Mind you, the responsibility for this doesn’t just sit within marketing or sales. The customer must be at the heart of every business decision made, from the Board of Directors down.

The truth is, customer acquisition is a lot like matchmaking. You should be looking for the right fit, not just the right now. Obviously, your end goal is to have as many potential customers as possible “swipe right.” But when they do, you have to be ready to get that relationship going. This is what drives customer lifetime value. So, given the choice between volume and value, wouldn’t you rather spend time, money, and available resources on building long-term relationships with the most profitable customers? (Your answer should be, “yes!”)