High-tech + Low-tech Growth Challenges for Mortgage Lenders

The mortgage industry has faced a number of challenges in recent years: technological advancements, increasing competition and lack of entry-level housing. All of which have added mounting pressure to mortgage lenders looking for growth and profitability. However, most lenders have also relied on low interest rates & the refinance boom to fuel their loan growth the last year or two. With new, well-financed lenders disrupting the market and the threats of higher mortgage rates and tighter lending standards in 2020 and 2021, leading lenders are starting to prepare for greater competition.

So how are lenders responding?

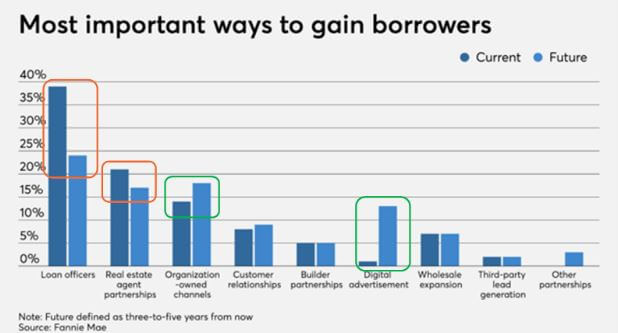

A recent article by National Mortgage News reviewing Fannie Mae’s Dec 2019 Mortgage Lender Sentiment Survey reports a majority of lenders are planning to fuel their growth over the next 3-5 years by diversifying where they source new loan leads. They will be adding to their traditional model of relying primarily on LO networks and RE partnerships, by dramatically increasing their investments to generate leads from digital channels (owned and paid). The goal is to help them generate more leads, particularly from the younger generation who favors mobile and digital engagement.

Interestingly, at the same time, additional articles from National Mortgage News have called out that despite this shift to more digital mortgages, Personalization still matters. Although more future customers will be researching more online, and looking for more efficient online options to streamline much of the borrowing process, it does not mean their journey ends behind a screen. When borrowing hundreds of thousands of dollars on a home loan, it turns out most people (even millennials) state that they prefer at some point to talk to a human being.

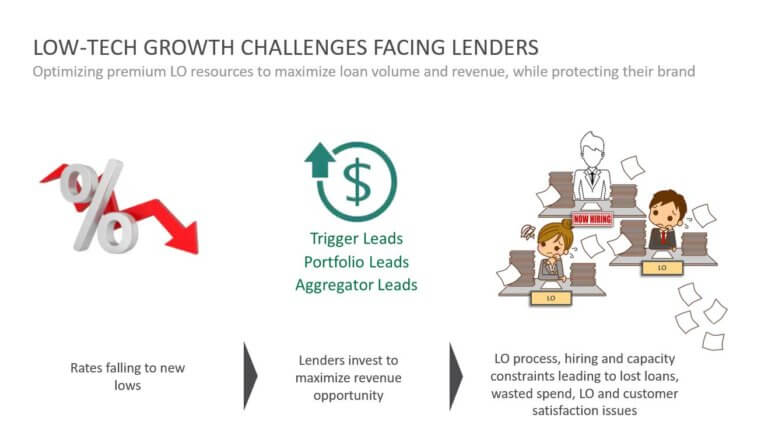

However, in the very low rate environment we have experienced for the last year, many lenders we work with are “jumping in” with increased budgets to take advantage of this great lending opportunity. The biggest operational hurdle many face is keeping enough loan officer capacity on line, and operating at optimal efficiency, to keep up with demand. Added hiring increases labor costs that eat away at margins, while hiring delays stall growth and reduce revenue. Finding ways to maximize the amount of existing loan officer capacity focused on closing loans (vs being distracted with qualifying or nurturing lower-quality leads), while increasing their efficiency at closing, is the virtuous cycle that generates maximum growth in closed loans units, revenue and profits.

However, in the very low rate environment we have experienced for the last year, many lenders we work with are “jumping in” with increased budgets to take advantage of this great lending opportunity. The biggest operational hurdle many face is keeping enough loan officer capacity on line, and operating at optimal efficiency, to keep up with demand. Added hiring increases labor costs that eat away at margins, while hiring delays stall growth and reduce revenue. Finding ways to maximize the amount of existing loan officer capacity focused on closing loans (vs being distracted with qualifying or nurturing lower-quality leads), while increasing their efficiency at closing, is the virtuous cycle that generates maximum growth in closed loans units, revenue and profits.

This blog reviews the best practices we have identified over 15 years to drive loan volume and revenue growth for both large traditional lenders and disruptive digital startups (across mortgages, HELOC, equity loans, educational and personal). These fall into two basic categories.

- High-tech (Digital Growth) strategies

- Low-tech (LO Efficiency) strategies

Strategy 1: Building a Successful, Modern Digital Growth Strategy

The digital native generation – millennials – are finally coming to market after years of postponing home ownership. So if you want to be profitable in the years to come there are 3 key principals we guide our marketing executive clients to think about and solve.

1. Separating KPIs from Economics

Too many marketers focus on upper-funnel vanity metrics (e.g. impressions, clicks, CTR, CVR) instead of translating and speaking at all times about their activity in terms of its bottom-line impact on growth metrics that drive their business (e.g. how many units were sold, at what unit value, at what CPFL or LTV/CAC). Only by refocusing on business growth metrics can a marketer judge and measure the true value of different growth strategies.

2. Full Funnel Visibility

Many lender marketers say they have this, but yet they cannot answer what is their current CPFL. This is because getting this data is hard. It is captured in multiple systems across both sales and marketing, which means it is typically not available to marketing (or if it is, it is not generated daily, but at most monthly) due to the complexity in pulling it together. The lack of having real-time data on the cost per unit sold (CPFL) prevents marketers from having the insights needed to guide media decisions to drive real bottom-line growth. Marketers are too often blind to the true economic impact of their decisions on the business, limiting their ability to delivery true growth.

3. Segments Before Channels

Once you have access to a real-time, full-funnel view into your marketing performance, you can use that data to then answer what are your highest-value target customer segments to prioritize (e.g. which generate higher LTV/CAC). By knowing what each segment is worth, and what they cost you, by channel, only then will you be armed to build the optimal media plan (across each channel) to maximize your total business growth at the lowest blended cost.

Our Feb 2020 webinar with Blend talks in more detail about how leading mortgage lenders can use these lessons to modernize their digital customer acquisition strategy to generate loan growth in 2020 and beyond (view the webinar here).

Strategy 2: Leveraging a Contact Center To Maximize LO Closed Sales

Over the last 15 years, our Contact Center Services have partnered in growth campaigns with clients operating in several complex, considered-purchase product environments (e.g. lending, real estate, education, B2B technology and B2C subscription services). In each we proved how strategically leveraging call center resources:

- Satisfied the personalization needs of the potential borrower.

- Created a positive customer experience that strengthened their relationship with the lender’s brand.

- Improved conversion rates by proactively engaging potential borrowers (e.g. loan app not completed) in a live discussion to accelerate their movement down the sales process.

- Qualified out leads that would not qualify for a loan or were not serious about applying today, before having them speak with a loan officer.

By strategically leveraging a call center team to offload some of this early-stage work otherwise left to LOs, the number of leads that can move through the sales process increases dramatically. This results in increasing closed loan volumes by maximizing the LO time spent closing qualified loan applicants – while simultaneously reducing the new LO hiring requirements to reach those higher closed-loan numbers.

Our whitepaper “The Power of the Call: Your Secret Weapon to Maximize Revenue and Reduce Costs” describes the specific methods for leveraging a Contact Center to help you maximize the loan-closing impact of your existing LO resources, improve conversion rates and reduce cost-per-lead (download the whitepaper here).

Where is your loan growth going to come from? Get the insights.

The refinance boom drove a lot of business in 2019. However, most lenders haven’t invested enough in their digital strategy to sustain growth if rates reverse in 2020, let alone to compete with well-financed new lenders disrupting the market.

In a recent webinar featuring Katherine Campbell from Assurance Financial, Katy Keim from LQ Digital and Terrence Caldwell from Blend titled ‘How to Thrive as a Mortgage Lender of the Future‘ strategies were shared on how to tackle that exact problem.

In the webinar, these digital innovation leaders discuss how to modernize the customer buyer journey and experience in order to generate loan growth in 2020 and beyond.

Learn actionable takeaways to grow your business, such as:

- Drive real business growth by tying marketing activities to your business economics

- Acquisition programs that focus on reducing Cost per Funded Loan

- A tech foundation for the borrowers journey – guiding them from “Hello” to “Close”

Take the first step. Click on this link to download the webinar.

Power of the Call: Your Secret Weapon to Maximize Revenue and Reduce Costs

Use outsourced contact center services to increase lead conversion and decrease CPL

Today’s businesses face the same challenge: how to grow by converting more profitable leads, acquiring more valuable customers to generate more revenue while keeping lead and sales costs flat — or, better yet, even reducing them. For businesses selling products or services that are expensive, complex to buy, sold in mature or highly-competitive markets, or where the time between lead creation and closing a transaction is long, doing so gets even harder.

Imagine the stress for a marketing leader deciding where to spend media budgets to generate new leads this month without useful data on how similar investments from a month ago panned out. Or for a sales leader having to choose which sales people should spend scarce time qualifying leads (instead of focusing on closing sales) without data to judge the future revenue benefit when this month’s sales targets still need to be hit.

Over the last 13 years, our Contact Center Services have partnered with clients operating in these complex considered-purchase environments and we’re sharing our 3 key lessons that we’ve learned to help our clients maximize their resources, improve conversion and deliver greater ROI back to their business.

Download this white paper to learn more our capabilities and client case studies.

Digital Advertising Doesn’t Always Work (But It Can!)

This post is bi-lined by Christina Martin, Executive Director, Real Estate Marketing at USAA and a seasoned Digital Marketer with over two decades experience in financial services, including roles at Moneygram, United Capital Financial Advisors, and First Horizon Home Loans/First Tennessee (MetLife Home Loans). She shares her perspective here from speaking at Leads Con 2017 in a session entitled: From Search Campaign to Lead Qualification & Transfer – Using Data Analytics to Drive Volume. USAA is a LQ Digital client.

It may be time to take a different approach to avoid spending budget on wasted leads

It’s no secret that digital advertising has been steadily on the rise for a number of years now. In eMarketer’s latest quarterly projections for 2017, digital ad spend in the U.S. alone will grow by 15.9 percent to a whopping $83 billion in total revenue. Of course, it should come as no surprise that Google and Facebook continue to dominate this space, commanding 60 cents of every dollar spent.

These trends don’t show any signs of slowing, even as more marketers turn their attention and budgets to mobile advertising. In fact, the digital advertising industry is about to set a new milestone: by 2018, digital ad spend will surpass TV ad spend for the first time – and continue growing. That shouldn’t be news to marketers. The time to take action was yesterday; just look at the data. As digital continues to pull share away from TV, there’s no question that it should make up a big part of any marketer’s media plan in the year ahead. This basically means that the way we approach, plan, and execute digital advertising campaigns needs to fundamentally change if we expect to break through the noise and connect in a meaningful way with all-too-easily-distracted digital-first consumers.

So, given the relentless rise of digital ad spend, your knee-jerk reaction may be: “we must spend more to reach more consumers.” Generally speaking, you wouldn’t be wrong in making this assumption, but, in doing so, you are missing a big piece of the puzzle. Sure, by spending more on digital advertising, you will undoubtedly get a leg up on the competition in terms of overall impressions. But just because you reach more consumers doesn’t necessarily mean you’re reaching the right customers with compelling messages that motivates them to buy into your brand’s value proposition and eventually become actual customers. The problem here isn’t your spend; it’s how you’re spending your advertising dollars as well as what you’re doing to engage your target consumers.

Consider this a myth busted: greater spend doesn’t mean more positive results. If anything, it just gets you a lot more wasted leads and wastes your precious marketing budget. Industry-wide, it’s not all that surprising anymore to run into situations where, say, only eight percent of leads generated by a digital advertising campaign actually convert into something more substantial. When you do the simple math, that means the remaining 92 percent of those leads are basically useless or, in other words, deliver no value whatsoever. And in spite of the fact that many brands oftentimes see little return on their advertising spend (ROAS), they continue to pour more budget into advertising in hopes that the tables will eventually turn in their favor. It’s a nice idea, but, quite frankly, the wrong approach.

Additionally, it’s important to remember that digital advertising is not linear, nor is it executed via a “black and white” strategy either. ROAS in one channel may have a residual and beneficial impact in another, especially as ad spend grows. Social advertising is a great example of this. A recent Facebook study conducted with Nielsen Total Ad Ratings found that marketers who use Facebook ads to complement TV their ad spend can “boost audience reach and enhance the efficiency of their campaigns, particularly among younger audiences and light TV views.”

What’s the big takeaway here? It’s about time marketers got smarter about how they use (read: not spend) their digital advertising budgets. Here are a few pitfalls to avoid. First, ads need to be placed in the right channel. We know that all consumers are not created equally; digital advertising platforms aren’t either. Placing an ad in a channel that either fails to reach the right consumers or doesn’t incite the kind of action you need from them is a big waste of your budget. Don’t place ads on “popular” platforms just because they cater to a large audience. If your target consumers don’t spend their time there, you shouldn’t either.

Second, once you figure out where your target consumers spend their digital time, you still have to crack the code on how to speak to them – at least, in a way that gets them to act. Simply put, your message needs to resonate. Here’s some good news: practically every part of your digital advertising campaign can be optimized in real-time. Unlike that TV spot or static billboard you have running, you can test multiple digital ad units at the same time to see what works and cut out what doesn’t, instantly. Playing the digital advertising game is more than just purchase, create, publish, and wait. Every step in that process can be refined non-stop to drive results. Don’t just sit around until a campaign ends. If your message isn’t resonating, change it. The longer you run an ad with a mediocre call-to-action, the more budget you waste. Simple, right?

Lastly, if part of your digital advertising effort involves asking consumers to fill out a form to get more information, then be ready to get them that information immediately. Don’t make them wait. This isn’t dating. There’s no reason to be coy, but you shouldn’t stalk either. If you ask consumers to fill out a form for more information, only ask questions you absolutely need them to answer in order to make initial contact with them. If part of that information includes them giving you their phone number, then pick up the phone and call them back immediately. Doing so in less than one minute after receiving an inquiry can more than double conversion rates. Unfortunately, this is all too often where leads go to die. You’ve succeeded at getting consumers through the funnel to a point where they give you their contact information, only to keep them waiting. You’ve placed an ad on the right channel with the right message. Don’t lose that momentum while you’re already ahead.

If you’re following where I’m going with this, be sure your digital advertising spend is less about generating more leads and more about generating the right leads. This may be a lot to grasp at first because we’ve all become accustomed to measuring success through volume-based “vanity metrics” (more leads, more clicks, more impressions). Unfortunately, volume rarely equates to ROI. Why? Think of it this way: what’s the point of generating hundreds of leads if none of them actually convert? (Hint: it’s a waste of time and budget!)

Brands need to refocus their digital ad budgets on targeting only the most profitable customers or, more simply, the consumers who will generate the greatest overall lifetime value. There’s plenty of data and insights available to pinpoint and find the exact consumers we want to reach. So, in all honesty, knowing what resources are available to us to ensure every digital advertising campaign we run gets us closer to our most desired and relevant consumers, it seems silly that we’re still talking about wasted leads today. With the right planning, it’s avoidable.

To bring this idea around the “profitable customer” to life, I’m going to use an example from a talk I gave at LeadsCon Las Vegas earlier this year. USAA worked with LQ Digital to test paid search performance for a campaign effort intended to help veterans to purchase a home using their VA loan benefit. The goal was to reach VA-eligible veterans who weren’t already USAA members in a cost-effective way. So, that’s what we did – and LQ made it possible to track leads at every stage of the funnel, from initial search to loan purchase, to help us understand if we were, in fact, reaching the right customers at the right time.

Fortunately, we know a lot about what our members care about most and, from past campaigns, have learned what converts the best whenever we’ve got a new offer to share. For this campaign specifically, we worked with LQ to create a number of assets, from paid search ads to landing pages, that we knew would generate both interest and a response. Given the intensity and time-sensitive nature of this kind of purchase, we knew that adding things like call-back phone numbers on search ads (desktop and mobile) and providing a form to fill out on the landing pages would be most effective.

Here’s an interesting curveball (but something you should ultimately see less as a curveball and more like a best practice). Although the foundations of this campaign were built almost purely on digital, the magic really happened when a customer picked up the phone. During the run of this campaign, we saw the majority of qualified leads come from click-to-call (CTC) inbound mobile calls. These drove the highest conversion rates – more than desktop and mobile clicks – as well as a lower overall cost-per-lead (CPL). Additionally, of those consumers who clicked through and filled out the inquiry form on the landing page, our member service representatives were standing by to call them back immediately. Who knew that using online to drive offline conversion would be such a success?

Long story short: a solid digital customer acquisition strategy isn’t necessarily digital-only. Digital advertising alone is effective at getting the right consumers into the purchase funnel; a real conversation can move them through the funnel. Mobile CTC conversion rates alone speak volumes about the impact real human-to-human interaction can make to close a sale or win a new customer. Never discount the phone; it could be your greatest lead conversion asset.

To wrap this up, it’s safe to say that digital advertising isn’t really effective unless you:

- Know your target audience (“profitable customers”)

- Understand where they spend their digital time

- Develop (and test) messages that resonate most

- Be ready to pick up the phone when they call or make an inquiry

- Track and measure ROAS at every stage of the campaign journey

While this may seem like a simple recipe for success, many brands still make a number of avoidable missteps that ultimately lead to waste – wasted budget, wasted leads, wasted effort. Digital advertising can work hard for your brand as long as you take the time to set your campaigns up for success.

A Conversation That Counts

DON’T MISS OUT ON VALUABLE LEADS BY

SIMPLY FORGETTING TO ANSWER THE CALL

It seems as though marketers have become a little too comfortable – even complacent – with allowing digital to do the bulk of the heavy lifting for them. True, advancements in digital and mobile technologies have rapidly changed and, some would say, dramatically improved the way we approach our go-to-market and customer acquisition strategies.

It’s no secret that today’s consumers are submerged in digital media nearly all hours of the day. This has a lot to do with the addictive relationship many of us have with our smart phones and other smart devices. Digital media is a marketer’s sweet spot. That’s why technology has started to play a more central and somewhat ubiquitous role in day-to-day life, one that now keeps us plugged into the world of digital marketing 24/7.

Even though technology is becoming more and more prevalent in virtually everything we do from a marketing standpoint, we can’t forget that it nonetheless serves a specific purpose that actually has nothing to do with technology whatsoever: to connect real, living and breathing consumers with brands in more efficient and relevant ways. That’s the crux of digital marketing. Technology is nothing more than a conduit for encouraging those kinds of human interactions.

The issue here is that, through our growing dependence on technology, it becomes far too easy for us to start seeing those interactions merely as data points. Although all of that data can provide a tremendous amount of insight and value to marketers – and even allow them to measure success more accurately and with a higher degree of precision than ever before – it unfortunately fails to take into account the powerful role that real human interaction still plays in the end-to-end customer acquisition and lead conversion process.

This becomes even clearer when consumers find themselves making highly considered purchases. Whether they are applying for a mortgage, investing in an online degree program, buying an insurance policy, leasing a new car, or simply thinking about purchasing a big-ticket item, the decision-making process here isn’t as straightforward as clicking “buy now” and calling it a day. Consumers want to know that your product or service is the right one for them and, more often than not, they’ll have questions for you that they’ll need answered, fast.

So, where do they go to find this information? Online. The vast majority of them will turn to your website, social media, email, or chat to get help in the purchase process. And when they do, there’s a good chance they’ll leave a phone number. This is your moment to shine because it’s the moment where digital marketing passes the baton to a true human experience. Here’s the catch: you don’t have any time to waste. In spite of the many benefits that stem from this digital-first world we now live in, one major downside is that it’s raised expectations tenfold, if not more. Today’s consumers are all about instant gratification. When they reach out to you, you absolutely must be ready to respond. Immediately.

Now is the time to pick up the phone – within seconds. Why? If someone just filled out an inquiry form or requested a quote and left their contact number, it’s a good indicator that they are currently in the research mindset and potentially available to have a quick chat. The more lag time you leave, the greater chance that consumer has moved onto doing something else and is no longer thinking seriously about making that purchase. Or, even worse, they’ve moved on to a competitor. It’s really all about intent. By filling out an online inquiry form, a consumer has formally stated their interest to learn more about what your brand offers. That alone is worth its weight in gold. You shouldn’t ever have to think twice about picking up the phone to help get that consumer across the finish line.

If you’re not sold yet, let’s look at the numbers. A good amount of research has shown a strong correlation between speed-to-call and conversion. Picking up the phone to respond to a consumer’s inquiry in less than one minute can more than double conversion rates. Wait up to 30 minutes and conversion rates drop significantly – and then it’s just downhill from there. This basically tells us that intent should never be taken for granted. After all, it’s fleeting. The only way to capitalize on a consumer’s intent is to respond immediately. Anything short of that will simply make your job of converting a qualified lead into an actual customer a lot harder.

We’ve seen this first hand at LQ Digital.

Of those reached, we are able to convert around 25 percent of those leads, helping our customers, on average, see a 35 to 40 percent lift in overall conversion rates. And that’s all because we picked up the phone.

Because we spend so much time thinking about and optimizing our digital customer acquisition tactics, we sometimes fail to see the value and impact that something as simple as making a phone call can have on conversion rates. This isn’t only because it’s a matter of striking while the iron is hot. That’s only one part of the equation. The true value of picking up the phone is about the human interaction that takes place in that moment – particularly when something complex is at stake. You need to be there to answer questions or to help however you can when consumers need you most. Doing so builds trust, inspires loyalty, and helps consumers overcome any friction they may experience along their purchase journey.

The next time you find yourself planning a digital marketing campaign, don’t forget that the phone. It can be your greatest ally in driving conversion. The power of digital media is great; however, there are times when it really comes down to a conversation that counts.