The mortgage industry has faced a number of challenges in recent years: technological advancements, increasing competition and lack of entry-level housing. All of which have added mounting pressure to mortgage lenders looking for growth and profitability. However, most lenders have also relied on low interest rates & the refinance boom to fuel their loan growth the last year or two. With new, well-financed lenders disrupting the market and the threats of higher mortgage rates and tighter lending standards in 2020 and 2021, leading lenders are starting to prepare for greater competition.

So how are lenders responding?

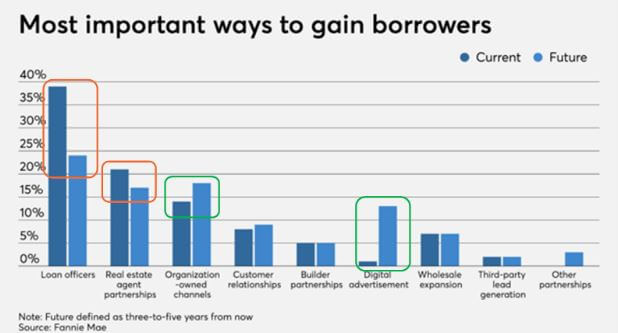

A recent article by National Mortgage News reviewing Fannie Mae’s Dec 2019 Mortgage Lender Sentiment Survey reports a majority of lenders are planning to fuel their growth over the next 3-5 years by diversifying where they source new loan leads. They will be adding to their traditional model of relying primarily on LO networks and RE partnerships, by dramatically increasing their investments to generate leads from digital channels (owned and paid). The goal is to help them generate more leads, particularly from the younger generation who favors mobile and digital engagement.

Interestingly, at the same time, additional articles from National Mortgage News have called out that despite this shift to more digital mortgages, Personalization still matters. Although more future customers will be researching more online, and looking for more efficient online options to streamline much of the borrowing process, it does not mean their journey ends behind a screen. When borrowing hundreds of thousands of dollars on a home loan, it turns out most people (even millennials) state that they prefer at some point to talk to a human being.

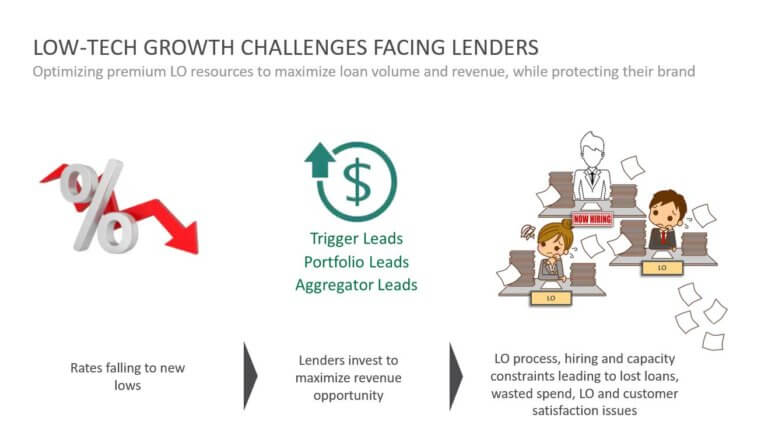

However, in the very low rate environment we have experienced for the last year, many lenders we work with are “jumping in” with increased budgets to take advantage of this great lending opportunity. The biggest operational hurdle many face is keeping enough loan officer capacity on line, and operating at optimal efficiency, to keep up with demand. Added hiring increases labor costs that eat away at margins, while hiring delays stall growth and reduce revenue. Finding ways to maximize the amount of existing loan officer capacity focused on closing loans (vs being distracted with qualifying or nurturing lower-quality leads), while increasing their efficiency at closing, is the virtuous cycle that generates maximum growth in closed loans units, revenue and profits.

However, in the very low rate environment we have experienced for the last year, many lenders we work with are “jumping in” with increased budgets to take advantage of this great lending opportunity. The biggest operational hurdle many face is keeping enough loan officer capacity on line, and operating at optimal efficiency, to keep up with demand. Added hiring increases labor costs that eat away at margins, while hiring delays stall growth and reduce revenue. Finding ways to maximize the amount of existing loan officer capacity focused on closing loans (vs being distracted with qualifying or nurturing lower-quality leads), while increasing their efficiency at closing, is the virtuous cycle that generates maximum growth in closed loans units, revenue and profits.

This blog reviews the best practices we have identified over 15 years to drive loan volume and revenue growth for both large traditional lenders and disruptive digital startups (across mortgages, HELOC, equity loans, educational and personal). These fall into two basic categories.

- High-tech (Digital Growth) strategies

- Low-tech (LO Efficiency) strategies

Strategy 1: Building a Successful, Modern Digital Growth Strategy

The digital native generation – millennials – are finally coming to market after years of postponing home ownership. So if you want to be profitable in the years to come there are 3 key principals we guide our marketing executive clients to think about and solve.

1. Separating KPIs from Economics

Too many marketers focus on upper-funnel vanity metrics (e.g. impressions, clicks, CTR, CVR) instead of translating and speaking at all times about their activity in terms of its bottom-line impact on growth metrics that drive their business (e.g. how many units were sold, at what unit value, at what CPFL or LTV/CAC). Only by refocusing on business growth metrics can a marketer judge and measure the true value of different growth strategies.

2. Full Funnel Visibility

Many lender marketers say they have this, but yet they cannot answer what is their current CPFL. This is because getting this data is hard. It is captured in multiple systems across both sales and marketing, which means it is typically not available to marketing (or if it is, it is not generated daily, but at most monthly) due to the complexity in pulling it together. The lack of having real-time data on the cost per unit sold (CPFL) prevents marketers from having the insights needed to guide media decisions to drive real bottom-line growth. Marketers are too often blind to the true economic impact of their decisions on the business, limiting their ability to delivery true growth.

3. Segments Before Channels

Once you have access to a real-time, full-funnel view into your marketing performance, you can use that data to then answer what are your highest-value target customer segments to prioritize (e.g. which generate higher LTV/CAC). By knowing what each segment is worth, and what they cost you, by channel, only then will you be armed to build the optimal media plan (across each channel) to maximize your total business growth at the lowest blended cost.

Our Feb 2020 webinar with Blend talks in more detail about how leading mortgage lenders can use these lessons to modernize their digital customer acquisition strategy to generate loan growth in 2020 and beyond (view the webinar here).

Strategy 2: Leveraging a Contact Center To Maximize LO Closed Sales

Over the last 15 years, our Contact Center Services have partnered in growth campaigns with clients operating in several complex, considered-purchase product environments (e.g. lending, real estate, education, B2B technology and B2C subscription services). In each we proved how strategically leveraging call center resources:

- Satisfied the personalization needs of the potential borrower.

- Created a positive customer experience that strengthened their relationship with the lender’s brand.

- Improved conversion rates by proactively engaging potential borrowers (e.g. loan app not completed) in a live discussion to accelerate their movement down the sales process.

- Qualified out leads that would not qualify for a loan or were not serious about applying today, before having them speak with a loan officer.

By strategically leveraging a call center team to offload some of this early-stage work otherwise left to LOs, the number of leads that can move through the sales process increases dramatically. This results in increasing closed loan volumes by maximizing the LO time spent closing qualified loan applicants – while simultaneously reducing the new LO hiring requirements to reach those higher closed-loan numbers.

Our whitepaper “The Power of the Call: Your Secret Weapon to Maximize Revenue and Reduce Costs” describes the specific methods for leveraging a Contact Center to help you maximize the loan-closing impact of your existing LO resources, improve conversion rates and reduce cost-per-lead (download the whitepaper here).